Bilanol/iStock via Getty Images

Thesis

In this article, I identify the key drivers of the electric potential lengthiness of the dry bulge carriers ‘ prosperity and besides state that Eagle Bulk Shipping ( EGLE ) seems to be one of the best buy out there based on its newly redemption broadcast, dividend policy, and undervaluation.

Why dry bulkers?

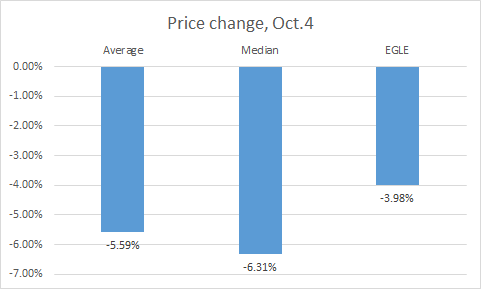

yesterday I published an article about Danaos ( DAC ), in which I provided some data about the recent correction of the stallion “ Marine Shipping Industry “ – the day before yesterday, the unharmed sector lost ~6 % ( median value ) and Eagle Bulk was no exception :

source : author ‘s calculations based on FinViz yesterday, as I expected, most of this dip was bought out – the asperity of damaging news was merely not enough to outweigh all those catalysts that are however relevant for this sector.

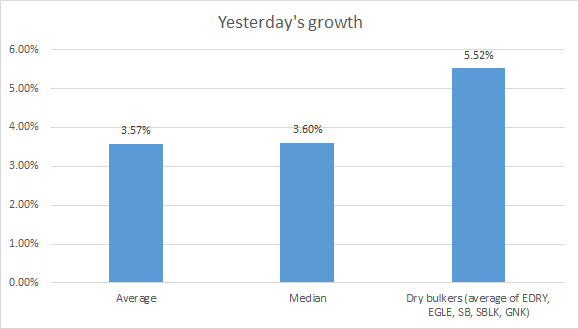

source : author ‘s calculations based on FinViz yesterday, as I expected, most of this dip was bought out – the asperity of damaging news was merely not enough to outweigh all those catalysts that are however relevant for this sector.  source : writer ‘s calculations based on FinViz As you can see, dry bulk carriers recovered the most. First of all, I associate this rally with the fact that the main negative news program was more related to container shipping companies like DAC, Global Ship Lease ( GSL ), and others. For dry bulk carriers, it had only an indirect impression. furthermore, I believe dry majority carriers now have even more tailwinds and reasons to prosper than container ship companies ( I am bullish on both sectors though ). Let ‘s define those reasons. Reason #1 – oil prices continue to rise. If you read some of my articles, you are probably mindful that high petroleum prices are good news specifically for dry bulk carriers, as opposed to tankers or container ships.

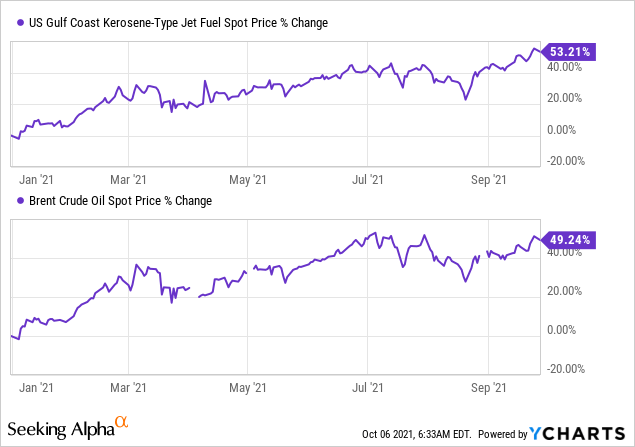

source : writer ‘s calculations based on FinViz As you can see, dry bulk carriers recovered the most. First of all, I associate this rally with the fact that the main negative news program was more related to container shipping companies like DAC, Global Ship Lease ( GSL ), and others. For dry bulk carriers, it had only an indirect impression. furthermore, I believe dry majority carriers now have even more tailwinds and reasons to prosper than container ship companies ( I am bullish on both sectors though ). Let ‘s define those reasons. Reason #1 – oil prices continue to rise. If you read some of my articles, you are probably mindful that high petroleum prices are good news specifically for dry bulk carriers, as opposed to tankers or container ships.  Data by YCharts

Data by YCharts

<...> And high fuel prices are good for dry bulk. They’re not good for the container business necessarily. They’re not necessarily good for the tanker business, because tankers carry fuel. But dry bulk ships do not carry fuel oil. They burn fuel oil, and the more expensive the fuel oil gets, the slower the fleet will tend to go. And therefore, in effect, the carrying capacity of the fleet is reduced, which drives charter rates up. So, the carbon tax is great for us. source : Hamish Norton ‘s words taken from “ Star Bulk Carriers Updates On Surging Bulk Markets ( Podcast Transcript ) ”

OPEC+ has decided not to increase production, so this led to a jumpstart in oil prices. however, the ascend in oil was not colossal since Saudi Arabia lowered selling prices for Asia. According to Reuters, “ the deep price cuts come as lockdowns across Asia to combat the highly infectious delta variant of the Coronavirus have capped fuel demand in the region. ” Anyway, I think that the upward swerve is probable to continue vitamin a long as flatulence and electricity prices rise – that leads us to another rationality why dry bulkers ‘ stocks are set to soar far. Reason #2 – winter is coming, so the topic of the energy crisis in China, the EU, and the US will gain momentum.

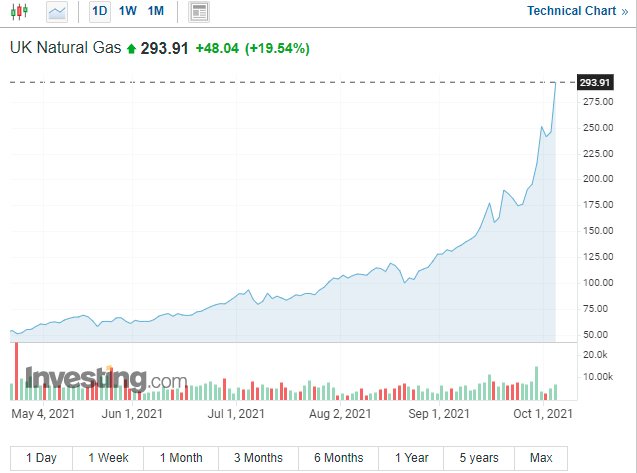

Natural natural gas contracts hit new highs in Europe on Tuesday, as soaring prices continue to put blackmail on the region ’ s energy sector ahead of the winter period. November contracts at the Dutch TTF hub — a european benchmark for natural gasoline — were trading at around 118 euros per megawatt hour ( MWH ) good after noon in London. The front-month abridge was up about 19 % on the day, setting a newfangled record senior high school, and has risen about 400 % since the begin of the year. beginning : CNBC, “ Gas monetary value surges to a record high in Europe on provision concerns ”

UK Natural Gas prices (NGLNMc1)

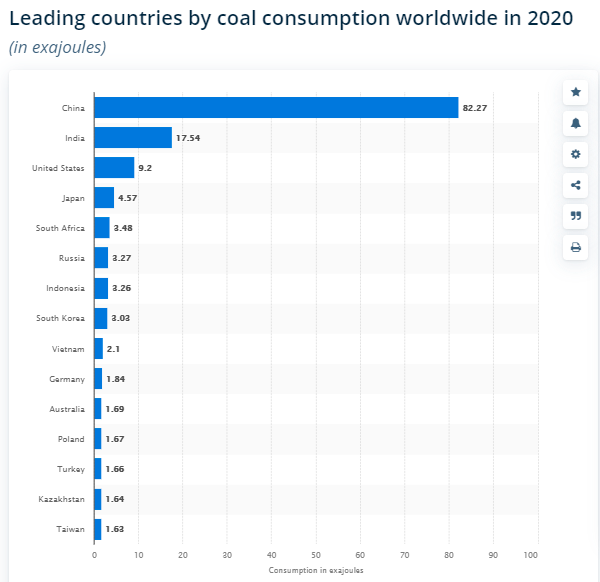

source : Investing.com The increase in natural accelerator prices, in my opinion, will lead to an increase in the net income of a ) LNG carriers such as FLEX LNG Ltd. ( FLNG ) and b ) our dry bulkers since at least in the brusque condition, coal consumption will grow. The rise in prices for natural natural gas has forced many enterprises to switch to coal, the production of which has importantly decreased in late years – a deficit has formed and, as we know, an intensification of the energy crisis occurred. char is one of the most common commodities transported by EGLE, so increased demand for it could lead to great profits by the end of 2021. Reason #3 – China ‘s actions concerning Taiwan suggest that australian coal and iron ore will be “ politically unacceptable ” for China. Against the background of all of the above, China besides needs coal to the bone, because despite all the statements about “ a bias towards environmental friendliness ”, the country is still identical much dependent on this dirty informant of energy.

Leading countries by coal consumption worldwide in 2020 (in exajoules)

Source: Statista.com

In 2019, approximately 96.3 percentage of China ‘s coal imports came from Australia ( ~77 million metric function tons ), however, tensions between the two countries forced China to look for other suppliers – chiefly Russia and South Asia. I have already mentioned this in my other articles, but then it was about iron ore. now the situation is aggravated by the tense situation with Taiwan – eleven Jinping “ has vowed to reunify the island, and he has n’t ruled out the use of military force to do so. ” I am not a political expert, but it seems to me that I do n’t have to be one to make the follow decision – the West will not stand away in the event of an attack on Taiwan ( a democratic submit ), which will further aggravate the situation. Without australian commodities, China will ordering both iron ore ( so necessary to increase production in the state ) and char from more distant countries, while increasing the net income of dry bulk carriers like EGLE – this can surely be considered a macroeconomic catalyst.

Why Eagle Bulk Shipping?

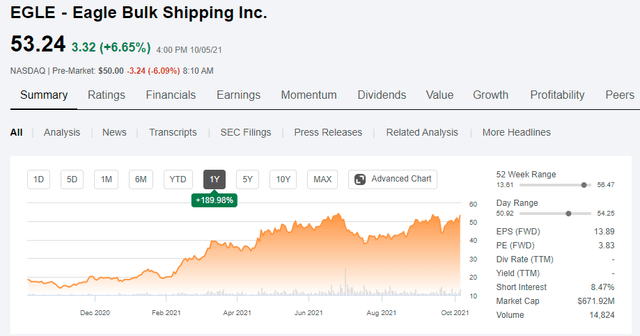

You may ask me : “ Okay, but why EGLE ? ” Well, I can give you a few chief reasons why. Firstly, this ship’s company, despite belonging to an diligence that has more than doubled over the by year ( EGLE itself has grown by ~190 % ), remains undercovered here, on Seeking Alpha – the most holocene article ( a gorgeous one, worth noting ) was written by J Mintzmyer over 3 months ago. In this involve, SA readers remain ignorant about it, although this detail caller has something to brag about. Secondly, the ship’s company launches a share redemption program and dividend policy. That ‘s what I was talking about in the paragraph above. EGLE besides refinanced honest-to-god debts on more golden terms, which will allow to “ comb ” the capital structure.

The refinance, which closed on Oct. 1, 2021, has significantly improved Eagle ‘s capital structure and increase fiscal flexibility, leading to reduction of ~ $ 8M in annual interest expense, a well as an extension of the nearest bank debt maturity to the goal of 2026.

Read more: A Man Quotes Maritime Law To Avoid Ticket

source : From SA newsworthiness

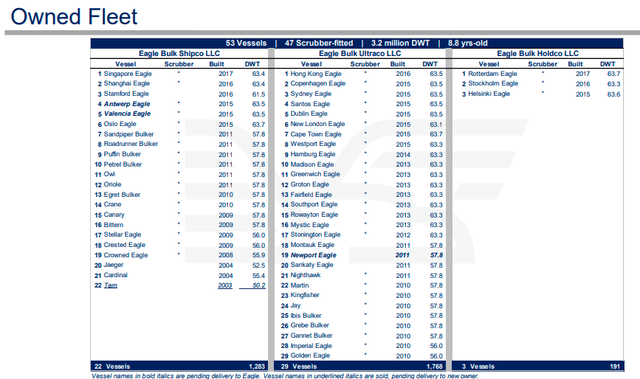

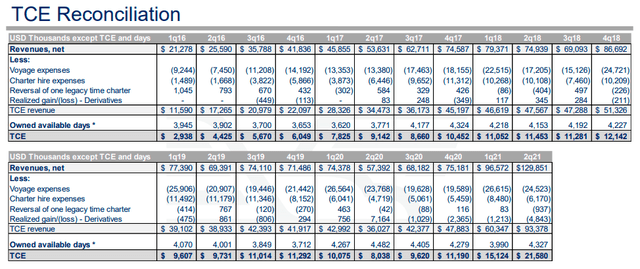

Thirdly, the fleet structure of EGLE brings less excitability – as J noted, “ midsized dry bulk rates are posting the strongest levels in more than 11 years and there ‘s besides little excitability, as contrasted to the larger Capesize market. ” This leads to more predictable TCE values and, as a consequence, more predictable EBITDA.

TCE Reconciliation

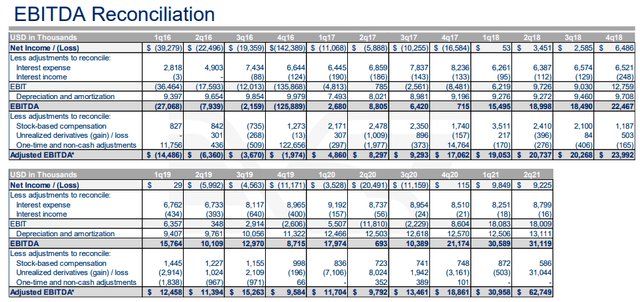

EBITDA Reconciliation

EGLE’s IR presentation, 2Q 2021

Bearing in mind the waive predictability, I propose to evaluate the party by discounting free cash flows.

Valuation

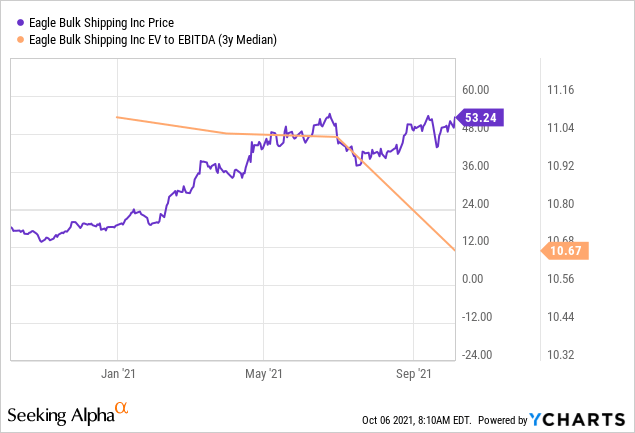

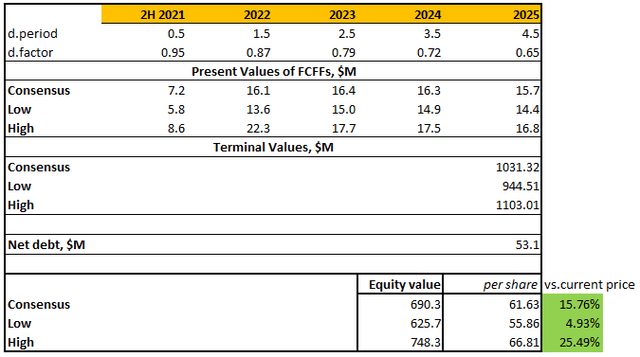

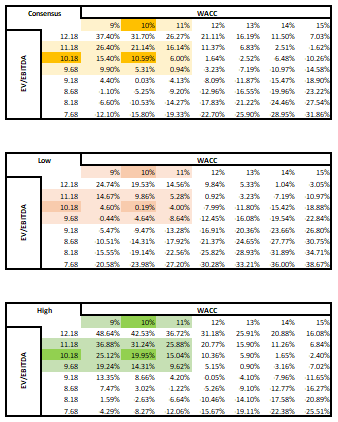

I ‘m going to use the like approach for valuing EGLE as I have done in my former articles on Danaos. The independent point of my set about is the follow assumption – the ship’s company will make equally much tax income as analysts expect from it. With this in mind, we can assume modal EBITDA margins and, as a consequence, complimentary cash flows. With a WACC of 10 % ( my standard discount rate rate for all ship companies ) and assuming the 3-y median EV/EBITDA of 10.47x as the exit multiple, we can answer the question : “ How depreciate or overvalued the company is, provided the Street is justly about its potential growth in the coming years ? ”  Data by YCharts here ‘s how the Street sees the next 3 years for EGLE in terms of its tax income :

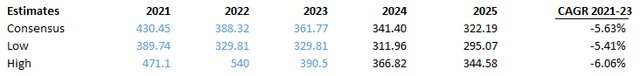

Data by YCharts here ‘s how the Street sees the next 3 years for EGLE in terms of its tax income :  source : tax income projections, author ‘s calculations based on SA data In all three scenarios, revenues are projected to fall on average from 5.41 % to 6.06 %. Therefore, I continued this course for the next 2 years ( 2024 and 2025 ). EBITDA ‘s margin has shown significant improvement over the past two years as a consequence of the continuing supercycle.

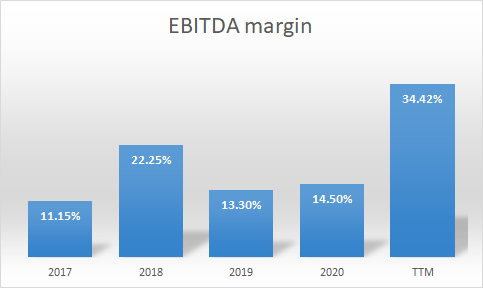

source : tax income projections, author ‘s calculations based on SA data In all three scenarios, revenues are projected to fall on average from 5.41 % to 6.06 %. Therefore, I continued this course for the next 2 years ( 2024 and 2025 ). EBITDA ‘s margin has shown significant improvement over the past two years as a consequence of the continuing supercycle.  generator : author ‘s calculations, based on EGLE ‘s financials however, I believe that the current charge of margin will besides fall along with tax income, albeit not sol precipitously – from 34.42 % ( TTM ) to 30 % ( 2025 ). On the contrary, the ratio of free cash flows to EBITDA will grow due to the update capital structure and previously described catalysts ( from 10.76 % of TTM to 25 % in 2025 ). consequently, I get the follow results :

generator : author ‘s calculations, based on EGLE ‘s financials however, I believe that the current charge of margin will besides fall along with tax income, albeit not sol precipitously – from 34.42 % ( TTM ) to 30 % ( 2025 ). On the contrary, the ratio of free cash flows to EBITDA will grow due to the update capital structure and previously described catalysts ( from 10.76 % of TTM to 25 % in 2025 ). consequently, I get the follow results :

DCF’s output, EGLE, author’s calculations

The results of this assessment are broadly not identical sensitive to key assumptions ( WACC and passing multiple ) :

Sensitivity tables, author’s calculations

Based on this, I conclude that EGLE is undervalued, which makes it a identical attractive theme to buy amid thus many catalysts around.

The impending correction and takeaway

While I was writing this article, EGLE corrected at the pre-market by > 6 % :

EGLE’s main page, Seeking Alpha

And this is happening throughout the diligence ( data at the moment of this writing ) :

Read more: Maritime search and rescue – Documentary

- Star Bulk Carriers Corp. (SBLK) -0.93% pre-market;

- Safe Bulkers, Inc. (SB) -2.52% pre-market;

- Navios Maritime Partners L.P. (NMM) -2.13%;

- Grindrod Shipping Holdings Ltd. (GRIN) -1.91%;

- Danaos Corporation -1.32%.

so when you read this article, the unharmed sector may be dropping like a rock again. And EGLE is experiencing the most serious atmospheric pressure of all. But the worst thing is that I do not understand what provokes this fall. The news program feeds are wide of information about Palantir ( PLTR ) and the approaching Levi Strauss ‘ ( LEVI ) reputation, but there is no news related to the impending fall ( I will be grateful if you share what you know in the comments ). In any case, at the clock time of this writing, I remain in the dark about the reasons for what is happening. possibly something in the diligence has changed dramatically, which we do not know even, and which can put an end to my thesis. Given the impend discipline, I propose to wait a spot and not buy right away – let the market breathe out again, front at the newsworthiness background and buy. I am planning to do so – yesterday I sold partially of other assets before loading up with DAC, but there is still a short impart in cash. Let ‘s see how events turn out on the horizon of respective months ( do n’t forget about stop-losses ) .