We discuss how to prepare a startup for an economic downturn.

RESOURCES & LINKS:

————————————————————————–

🚨 Join my Finance for Startups training program (with support from me, livestreams, and more):

⬇️ Download the video lecture file:

My Communities:

► Email list:

► Discord:

Related Startup Videos:

► Startup Fundraising Lifecycle:

► How VCs Calculate Customer Retention & LTV:

————————————————————————–

Recently there has been a big crash in fundraising markets. This is a huge issue for startups that rely on venture funding to survive. While we don’t know whether we will see a recession in the consumption economy yet, this is a good moment to prepare your business for uncertainty.

After you watch this video you’ll have a great framework for how to reduce burn, cut costs, extend your runway, and manage for success.

Sections:

0:15 opportunity cost of acting too slowly, don’t be in denial (adjust expectations)

2:06 overview of actions to take going into recession

2:32 May 2022 update – what we know vs. don’t know about downturn

6:40 unit economics analysis example – B2B vs. B2C – boosting profitability

13:44 slowing down growth / customer acquisition to extend runway (optimizing for cash flow instead of growth)

17:50 re-evaluate how you calculate burn rate & runway

18:49 layoffs “reductions in force” – for survival

20:37 repricing underwater employee stock options with new 409a

23:29 aggressively cut additional OPEX by renegotiating with vendors

24:20 work closely with existing investors to manage for a winning outcome

By the end of this video, you’ll have a much better understanding of how to navigate a startup through a recession – I guarantee it.

If you have questions – leave a comment below and I’ll try to help. Cheers!

#recession #startups #venturecapital

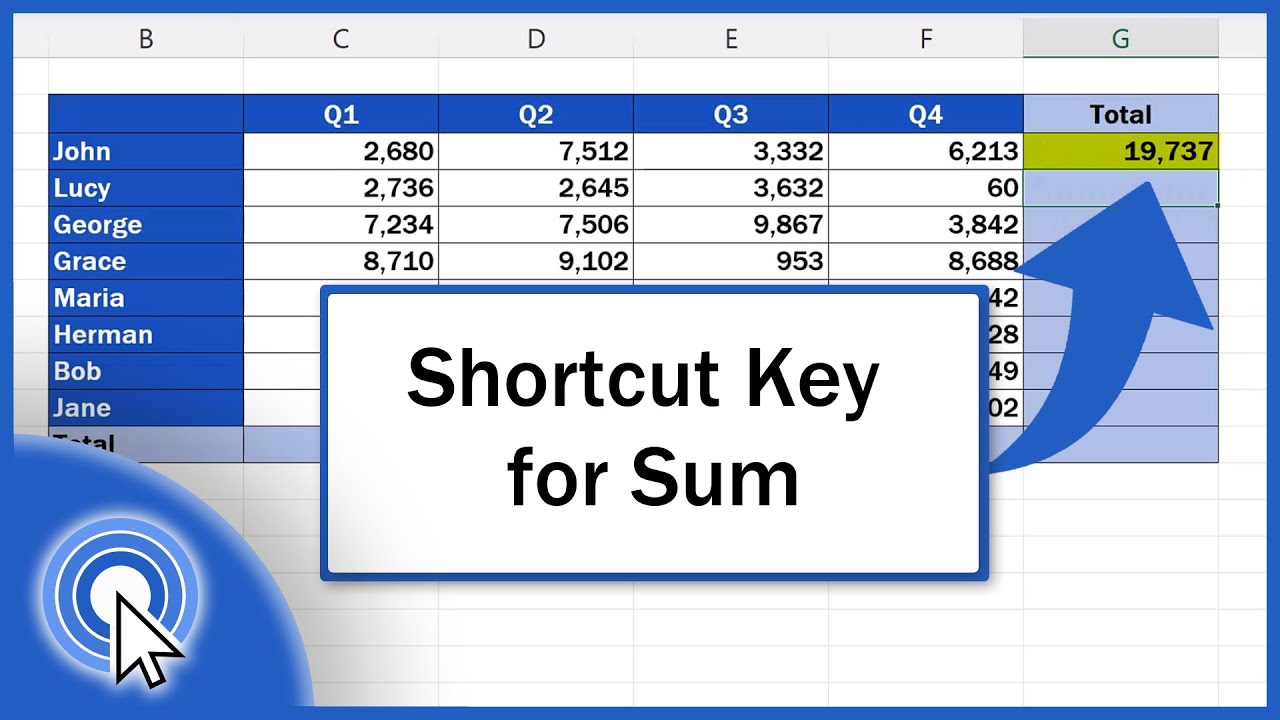

Watch more new videos about Excel Office | Synthesized by Mindovermetal English

Any questions – let me know here in the comments and I'll try to help 👇