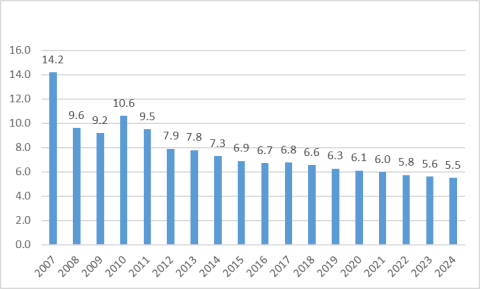

China ‘s growing global economic influence and the economic and barter policies it maintains have significant implications for the United States and hence are of major sake to Congress. While China is a big and growing market for U.S. firms, its incomplete conversion to a free-market economy has resulted in economic policies deemed harmful to U.S. economic interests, such as industrial policies and larceny of U.S. intellectual property. This report provides background on China ‘s economic rise ; describes its current economic structure ; identifies the challenges China faces to maintain economic growth ; and discusses the challenges, opportunities, and implications of China ‘s economic rise for the United States. In 2017, the Trump Administration launched a department 301 probe of China ‘s invention and intellectual place policies deemed harmful to U.S. economic interests. It subsequently raised tariffs by 25 % on $ 250 billion worth of imports from China, while China increased tariffs ( ranging from 5 % to 25 % ) on $ 110 billion worth of imports from the United States. such measures have sharply decreased bilateral deal in 2019. On May 10, 2019, President Trump announced he was considering raising tariffs on closely all remaining products from China. A drawn-out and escalating barter conflict between the United States and China could have veto consequences for the taiwanese economy. The taiwanese government has made invention a clear priority in its economic plan through a number of high-profile initiatives, such as “ Made in China 2025, ” a design announced in 2015 to upgrade and modernize China ‘s manufacture in 10 key sectors through across-the-board government aid in order to make China a major global musician in these sectors. however, such measures have increasingly raised concerns that China intends to use industrial policies to decrease the country ‘s reliance on foreign engineering ( including by locking out extraneous firms in China ) and finally dominate global markets. As China ‘s economy has matured, its real GDP increase has slowed importantly, from 14.2 % in 2007 to 6.6 % in 2018, and that increase is projected by the International Monetary Fund ( IMF ) to fall to 5.5 % by 2024. The chinese government has embraced slower economic growth, referring to it as the “ new convention ” and acknowledging the need for China to embrace a newly growth model that relies less on fixed investment and export, and more on individual consumption, services, and initiation to drive economic growth. such reforms are needed in arrange for China to avoid hitting the “ middle-income trap, ” when countries achieve a certain economic level but begin to experience aggressively diminishing economic growth rates because they are ineffective to adopt newly sources of economic growth, such as invention.

anterior to the initiation of economic reforms and trade liberalization about 40 years ago, China maintained policies that kept the economy very hapless, stagnant, centrally controlled, vastly ineffective, and relatively sequester from the ball-shaped economy. Since opening up to extraneous trade and investment and implementing free-market reforms in 1979, China has been among the world ‘s fastest-growing economies, with real annual megascopic domestic product ( GDP ) increase averaging 9.5 % through 2018, a pace described by the World Bank as “ the fastest sustain expansion by a major economy in history. ” such growth has enabled China, on median, to double its GDP every eight years and helped raise an estimate 800 million people out of poverty. China has become the populace ‘s largest economy ( on a purchasing office parity basis ), manufacturer, trade trader, and holder of extraneous commute reserves. This in twist has made China a major commercial partner of the United States. China is the largest U.S. merchandise trade partner, biggest source of imports, and third-largest U.S. export market. China is besides the largest foreign holder of U.S. Treasury securities, which help fund the federal debt and keep U.S. interest rates moo. China ‘s rise from a inadequate developing area to a major economic ability in about four decades has been spectacular. From 1979 ( when economic reforms began ) to 2017, China ‘s actual gross domestic product ( GDP ) grew at an average annual rate of about 10 %. 1 According to the World Bank, China has “ experienced the fastest free burning expansion by a major economy in history—and has lifted more than 800 million people out of poverty. ” 2 China has emerged as a major global economic ability. For case, it ranks first in terms of economic size on a purchasing might parity ( PPP ) footing, value-added manufacture, trade trade, and holder of foreign rally reserves .

China ‘s rapid economic growth has led to a substantial increase in bilateral commercial ties with the United States. According to U.S. barter data, full trade between the two countries grew from $ 5 billion in 1980 to $ 660 billion in 2018. China is presently the United States ‘ largest trade trade partner, its third-largest export marketplace, and its largest reference of imports. many U.S. companies have extensive operations in China in order to sell their products in the booming chinese market and to take advantage of lower-cost parturiency for export-oriented manufacture. 3 These operations have helped some U.S. firms to remain internationally competitive and have supplied U.S. consumers with a variety of low-cost goods. China ‘s large-scale purchases of U.S. Treasury securities ( which totaled $ 1.1 trillion as of April 2019 have enabled the federal government to fund its budget deficits, which help keep U.S. interest rates relatively moo. 4

however, the emergence of China as a major economic power has raised concern among many U.S. policymakers. Some claim that China uses unfair trade practices ( such as an depreciate currency and subsidies given to domestic producers ) to flood U.S. markets with low-cost goods, and that such practices threaten american jobs, wages, and animation standards. Others contend that China ‘s growing practice of industrial policies to promote and protect certain domestic chinese industries or firms favored by the government, and its failure to take effective action against far-flung violation and larceny of U.S. intellectual place rights ( IPR ) in China, threaten to undermine the competitiveness of U.S. IP-intensive industries. In addition, while China has become a big and growing market for U.S. exports, critics contend that numerous trade and investment barriers limit opportunities for U.S. firms to sell in China, or force them to set up production facilities in China as the price of doing occupation there .

The chinese government views a growing economy as vital to maintaining social stability. however, China faces a phone number of major economic challenges that could dampen future growth, including distortive economic policies that have resulted in overreliance on specify investment and exports for economic emergence ( quite than on consumer demand ), government support for state-owned firms, a weak bank system, widening income gaps, growing contamination, and the relative miss of the rule of law in China. The taiwanese government has acknowledged these problems and has pledged to address them by implementing policies to increase the role of the market in the economy, boost invention, make consumer spend the driving force of the economy, expand social condom internet coverage, encourage the development of less-polluting industries ( such as services ), and crack down on official government corruptness. The ability of the chinese government to implement such reforms will likely determine whether China can continue to maintain relatively rapid economic growth rates, or will rather begin to experience significantly lower increase rates .

China ‘s growing economic baron has led it to become increasingly involve in ball-shaped economic policies and projects, particularly infrastructure growth. China ‘s Belt and Road first step ( BRI ) represents a grand scheme by China to finance infrastructure throughout Asia, Europe, Africa, and beyond. If successful, China ‘s economic initiatives could significantly expand export and investing markets for China and increase its “ soft exponent ” globally .

This report provides background on China ‘s economic originate ; describes its current economic structure ; identifies the challenges China faces to maintain economic growth ; and discusses the challenges, opportunities, and implications of China ‘s economic arise for the United States .

The History of China’s Economic Development

China’s Economy Prior to Reforms

prior to 1979, China, under the leadership of Chairman Mao Zedong, maintained a centrally planned, or command, economy. A boastfully share of the area ‘s economic end product was directed and controlled by the state, which set production goals, controlled prices, and allocated resources throughout most of the economy. During the 1950s, all of China ‘s individual family farms were collectivized into large communes. To support rapid industrialization, the central government undertook large-scale investments in physical and homo capital during the 1960s and 1970s. As a leave, by 1978 about three-fourths of industrial production was produced by centrally controlled, state-owned enterprises ( SOEs ), according to centrally planned output targets. secret enterprises and foreign-invested firms were generally barred. A cardinal finish of the taiwanese government was to make China ‘s economy relatively self-sufficient. Foreign trade was generally limited to obtaining those goods that could not be made or obtained in China. such policies created distortions in the economy. Since most aspects of the economy were managed and run by the cardinal government, there were no commercialize mechanisms to efficiently allocate resources, and thus there were few incentives for firms, workers, and farmers to become more productive or be concerned with the quality of what they produced ( since they were chiefly focused on production goals set by the politics ) .

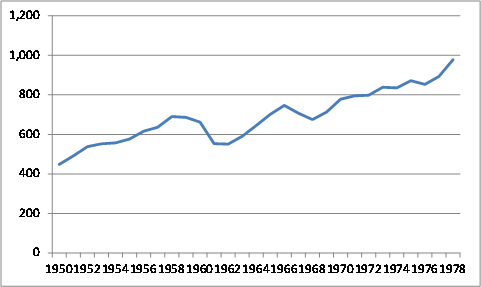

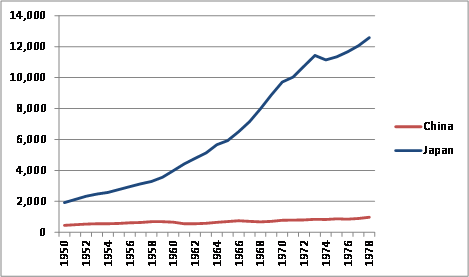

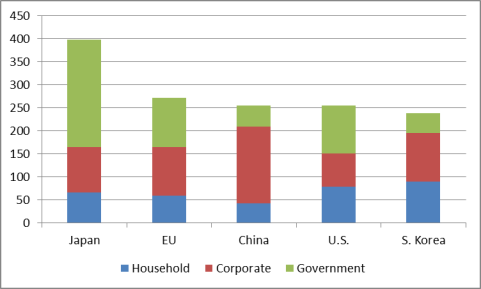

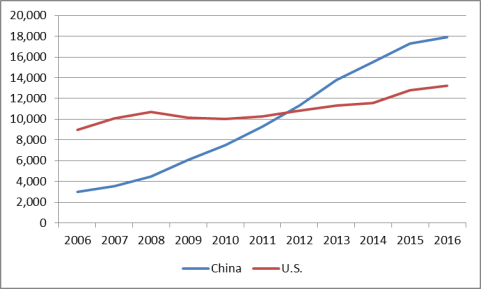

According to chinese politics statistics, China ‘s substantial GDP grew at an average annual rate of 6.7 % from 1953 to 1978, although the accuracy of these data has been questioned by many analysts, some of whom contend that during this period, chinese politics officials ( particularly at the subnational levels ) much overstate output levels for a variety of political reasons. Economist Angus Maddison puts China ‘s actual modal annual real GDP growth during this menstruation at about 4.4 %. 5 In summation, China ‘s economy suffered meaning economic downturns during the leadership of Chairman Mao Zedong, including during the Great Leap Forward from 1958 to 1962 ( which led to a massive famine and reportedly the deaths of up to 45 million people ) 6 and the cultural Revolution from 1966 to 1976 ( which caused widespread political chaos and greatly disrupted the economy ). From 1950 to 1978, China ‘s per head GDP on a purchasing power parity ( PPP ) footing, 7 a park measurement of a country ‘s exist standards, doubled. however, from 1958 to 1962, taiwanese live standards fell by 20.3 %, and from 1966 to 1968, they dropped by 9.6 % ( see Figure 1 ). In addition, the growth in chinese life standards paled in comparison to those in the West, such as Japan, as indicated in Figure 2 .

visualize 1. taiwanese Per Capita GDP : 1950-1978

( $ billions, PPP basis )

|

|

|

Source: Angus Maddison, Historical, Statistics of the World Economy : 1-2008 AD .

|

calculate 2. Comparison of Chinese and japanese Per Capita GDP : 1950-1978

( $ billions, PPP footing )

|

|

|

Source: Angus Maddison, Historical, Statistics of the World Economy : 1-2008 AD .

|

In 1978, ( shortly after the death of Chairman Mao in 1976 ), the chinese government decided to break with its Soviet-style economic policies by gradually reforming the economy according to free market principles and opening up trade wind and investment with the West, in the hope that this would significantly increase economic growth and raise survive standards. As chinese leader Deng Xiaoping, the architect of China ‘s economic reforms, put it : “ Black caterpillar, white cat, what does it matter what color the cat is arsenic long as it catches shiner ? ” 8

The Introduction of Economic Reforms

Beginning in 1979, China launched respective economic reforms. The central government initiated monetary value and ownership incentives for farmers, which enabled them to sell a parcel of their crops on the barren market. In summation, the government established four particular economic zones along the slide for the function of attracting foreign investment, boosting exports, and importing high engineering products into China. Additional reforms, which followed in stages, sought to decentralize economic policymaking in respective sectors, specially trade. Economic control of versatile enterprises was given to provincial and local governments, which were broadly allowed to operate and compete on dislodge market principles, preferably than under the direction and guidance of state planning. In accession, citizens were encouraged to start their own businesses. Additional coastal regions and cities were designated as open cities and development zones, which allowed them to experiment with free-market reforms and to offer tax and trade incentives to attract foreign investment. In summation, state price controls on a wide range of products were gradually eliminated. Trade liberalization was besides a major key to China ‘s economic achiever. Removing trade barriers encouraged greater contest and attracted FDI inflows. China ‘s gradual execution of economic reforms sought to identify which policies produced golden economic outcomes ( and which did not ) so that they could be implemented in other parts of the nation, a process Deng Xiaoping reportedly referred to as “ crossing the river by touching the stones. ” 9

China’s Economic Growth and Reforms: 1979-the Present

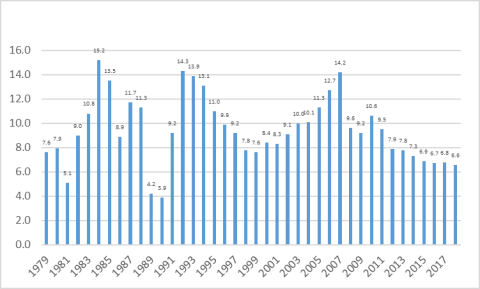

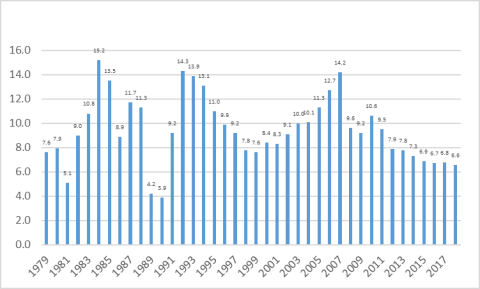

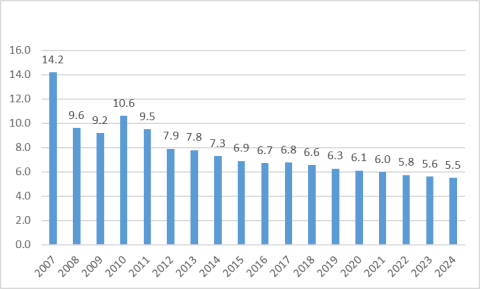

Since the presentation of economic reforms, China ‘s economy has grown substantially faster than during the pre-reform period, and, for the most partially, has avoided major economic disruptions. 10 From 1979 to 2018, China ‘s annual real GDP averaged 9.5 % ( see Figure 3 ). This has meant that on average China has been able to double the size of its economy in actual terms every eight years. The global economic slowdown, which began in 2008, had a meaning impingement on the taiwanese economy. China ‘s media reported in early 2009 that 20 million migrant workers had returned home after losing their jobs because of the fiscal crisis and that real GDP growth in the fourth quarter of 2008 had fallen to 6.8 % year-on-year. The taiwanese government responded by implementing a $ 586 billion economic stimulation box, aimed largely at fund infrastructure and loosening monetary policies to increase bank lending. 11 such policies enabled China to counter the effects of the sharp ball-shaped fall in demand for chinese products. From 2008 to 2010, China ‘s actual GDP increase averaged 9.7 %. however, the rate of GDP growth declined slowed for the adjacent six consecutive years, falling from 10.6 % in 2010 to 6.7 % in 2016. real GDP ticked up to 6.8 % in 2017, but slowed to 6.6 % in 2018, ( although it rose to 6.8 % in 2017 ). The IMF ‘s April 2019 World Economic Outlook projects that China ‘s actual GDP growth will slow each year over the adjacent six years, falling to 5.5 % in 2024 ( Figure 4 ). 12 many economists warn that China ‘s economic increase could slow promote if the United States and China continue to impose punitive economic measures against each other, such the tariff hikes that have resulted from U.S. carry through under section 301 and chinese retaliation. The Organization for Economic and Cooperation and Development ( OECD ) projects that increased tariffs on all trade between the United States and China could reduce China ‘s very GDP in 2021-2022 by 1.1 % proportional to the OECD ‘s baseline economic projections. 13

figure 3. taiwanese annual Real GDP Growth : 1979-2018

( share variety )

|

|

|

figure 4. China ‘s veridical annual GDP Growth : 2007-2018 and Projections through 2024

( percentage )

|

|

|

Source: IMF, World Economic Outlook Database, April 2019 ,

|

Causes of China’s Economic Growth

Economists generally attribute much of China ‘s rapid economic growth to two main factors : large-scale capital investment ( financed by big domestic savings and extraneous investment ) and rapid productiveness growth. These two factors appear to have gone together hand in hand. economic reforms led to higher efficiency in the economy, which boosted output and increase resources for extra investing in the economy .

China has historically maintained a high rate of savings. When reforms were initiated in 1979, domestic savings as a share of GDP stood at 32 %. however, most chinese savings during this period were generated by the profits of SOEs, which were used by the central politics for domestic investment. economic reforms, which included the decentralization of economic product, led to hearty emergence in Chinese family savings adenine well as corporate savings. As a result, China ‘s gross savings as a percentage of GDP is the highest among major economies. The large level of domestic savings has enabled China to support a high grade of investment. In fact, China ‘s gross domestic savings levels far exceed its domestic investment levels, which have made China a big net ball-shaped lender .

respective economists have concluded that productiveness gains ( i.e., increases in efficiency ) have been another major agent in China ‘s rapid economic emergence. The improvements to productivity were caused largely by a reallocation of resources to more productive uses, particularly in sectors that were once heavily controlled by the cardinal government, such as agriculture, trade, and services. For exemplar, agrarian reforms boosted product, freeing workers to pursue employment in the more productive fabricate sector. China ‘s decentralization of the economy led to the emanation of non-state enterprises ( such as private firms ), which tended to pursue more productive activities than the centrally controlled SOEs and were more market-oriented and more effective. additionally, a greater share of the economy ( chiefly the export sector ) was exposed to competitive forces. local and peasant governments were allowed to establish and operate assorted enterprises without intervention from the government. In addition, FDI in China brought with it raw engineering and processes that boosted efficiency .

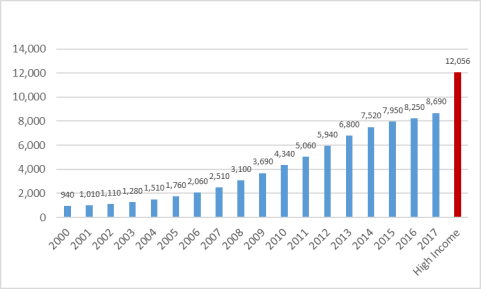

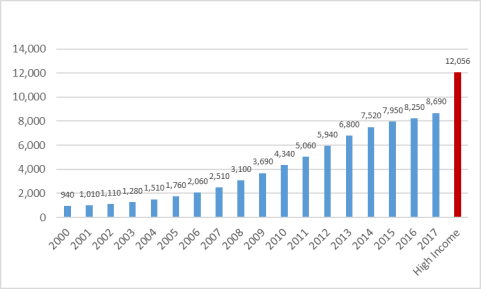

however, as China ‘s technical growth begins to converge with major develop countries ( i, through its adoption of extraneous engineering ), its level of productivity gains, and thus, veridical GDP growth, could slow significantly from its historic levels unless China becomes a major center for new engineering and invention and/or implements newly comprehensive economic reforms. several developing economies ( notably respective in Asia and Latin America ) experienced rapid economic growth and growth during the 1960s and 1970s by implementing some of the same policies that China has utilized to date to develop its economy, such as measures to boost exports and to promote and protect sealed industries. however, at some luff in their development, some of these countries began to experience economic stagnation ( or much slower growth compared to previous levels ) over a prolong time, a phenomenon described by economists as the “ middle-income trap. ” 14 This means that several developing ( low-income ) economies were able to transition to a middle-income economy, but because they were unable to sustain high levels of productiveness gains ( in share, because they could not address structural inefficiencies in the economy ), they were unable to transition to a high-income economy. 15 China may be at a like crossroads now. The World Bank classifies development levels of economies using a per head gross national income ( GNI ) methodology. 16 According to the World Bank, China went from a low-income economy to a low-middle-income economy in 1997, and in 2010, it became an upper-middle-income country. China ‘s 2017 per caput GNI ( at $ 8,690 ) was 38.7 % below the level China would need to obtain to become a high-income economy. The taiwanese politics projects that China can cross the high-income threshold by 2025. It hopes to achieve this largely by making initiation a major generator of future economic growth. Skeptics contend that initiation growth in China will be hard to achieve, specially if it is chiefly state-driven and imposes new restrictions on alien firms ,

figure 5. World Bank Measurements of China ‘s Per Capita GNI : 2000-2017

( $ U.S. )

|

|

Source: World Bank

Notes: Bar in loss indicates the flush China would need to reach to become a high-income economy .

|

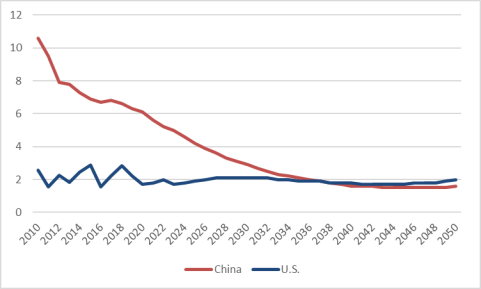

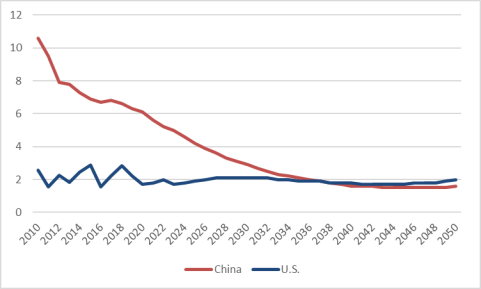

The Economist Intelligence Unit ( EIU ) projects that China ‘s actual GDP growth will slow well over the following several decades, finally converging on U.S. growth rates by the class 2037 ( U.S. and chinese veridical GDP growth rates are both projected at 1.9 % ). For some years thereafter, EIU projects U.S. GDP increase to be greater than China ‘s ( Figure 6 ). 17

figure 6. U.S. and taiwanese Annual Real GDP Growth Rates in 2010-2018 and Projections through 2050

( percentage )

|

|

|

Source: EIU Database ( accessed on June 24, 2019 ) .

|

The chinese politics has indicated its desire to move away from its stream economic mannequin of fast growth at any monetary value to more “ chic ” economic increase, which seeks to reduce reliance on energy-intensive and high-polluting industries and trust more on high engineering, green energy, and services. China besides has indicated it wants to obtain more poise economic growth. ( These issues are discussed in more detail later in the reputation. )

Measuring the Size of China’s Economy

The rapid growth of the chinese economy has led many analysts to speculate if and when China will overtake the United States as the “ world ‘s largest economic ability. ” The “ actual ” size of China ‘s economy has been a submit of extensive debate among economists. Measured in U.S. dollars using nominal rally rates, China ‘s GDP in 2018 in nominal U.S. dollars was $ 13.4 trillion, which was 65.3 % of the size of the U.S. economy, according to estimates made by the IMF. China ‘s 2018 per head GDP in nominal dollars was $ 9,608, which was 15.3 % of the U.S. per head degree .

many economists contend that using nominal exchange rates to convert Chinese data ( or those of other countries ) into U.S. dollars fails to reflect the true size of China ‘s economy and living standards proportional to the United States. noun phrase change rates merely reflect the prices of foreign currencies vis-à-vis the U.S. dollar, and such measurements exclude differences in the prices for goods and services across countries. To illustrate, one U.S. dollar exchanged for local currentness in China would buy more goods and services there than it would in the United States. This is because prices for goods and services in China are generally lower than they are in the United States. conversely, prices for goods and services in Japan are broadly higher than they are in the United States ( and China ). frankincense, one dollar exchanged for local japanese currentness would buy fewer goods and services there than it would in the United States. Economists attempt to develop estimates of rally rates based on their actual buying office relative to the dollar in ordering to make more accurate comparisons of economic data across countries, normally referred to as purchasing power parity ( PPP ) .

The PPP exchange rate increases the ( estimated ) measurement of China ‘s economy and its per head GDP. According to the IMF ( which uses price surveys conducted by the World Bank ), prices for goods and services in China are about half the flush they are in the United States. Adjusting for this price differential gear raises the value of China ‘s 2018 GDP from $ 13.4 trillion ( nominative dollars ) to $ 25.3 trillion ( on a PPP basis ) ( see Table 1 ). 18 IMF data indicate that China overtook the United States as the populace ‘s largest economy in 2014 on a PPP footing. 19

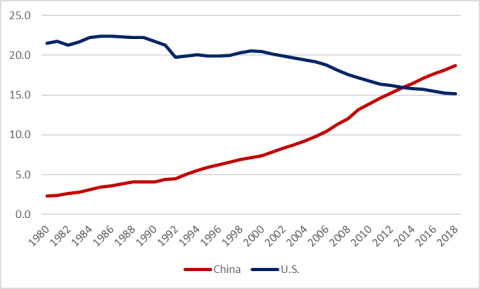

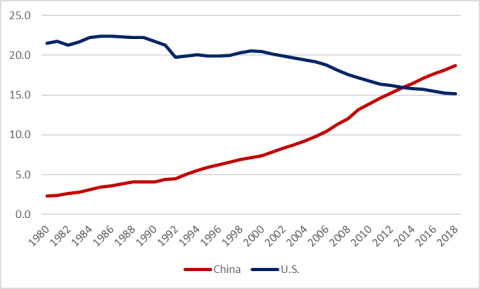

China ‘s parcel of ball-shaped GDP on a PPP basis rose from 2.3 % in 1980 to an estimated 18.3 % in 2017, while the U.S. share of ball-shaped GDP on a PPP basis fell from 24.3 % to an estimated 15.3 %. 20 This would not be the first time in history that China was the worldly concern ‘s largest economy ( see text box ). China ‘s economic dominance as the world largest economy has been impressive, particularly considering that in 1980, China ‘s GDP on a PPP basis was lone one-tenth that of the United States ( see

Figure 7 ). The IMF predicts that by 2024, China ‘s economy will be 56 % larger than the U.S. economy on a PPP basis .

mesa 1. Comparisons of Chinese, Japanese, and U.S. GDP and Per Capita GDP in Nominal U.S. Dollars and a Purchasing Power Parity Basis : 2018

|

|

China

|

United States

|

|

noun phrase GDP ( $ billions )

|

|

|

|

GDP in PPP ( $ billions )

|

|

|

|

nominative Per Capita GDP ( $ )

|

|

|

|

Per Capita GDP in PPP ( $ )

|

|

|

Source: IMF, World Economic Forum .

The Decline and Rise of China ‘s economy

According to a study by economist Angus Maddison, China was the world ‘s largest economy in 1820, accounting for an estimate 32.9 % of global GDP. however, foreign and civil wars, home discord, weak and ineffective governments, natural disasters ( some of which were man-made ), and distortive economic policies caused China ‘s share of global GDP on a PPP footing to shrink importantly. By 1952, China ‘s plowshare of ball-shaped GDP had fallen to 5.2 %, and by 1978, it slid to 4.9 %. The adoption of economic reforms by China in the late 1970s led to a billow in China ‘s economic increase and helped restore China as a major global economic office .

generator : The Organization for Economic Cooperation and Development, chinese Economic operation in the Long Run, 960-2030, by Angus Maddison, 2007 .

|

|

figure 7. U.S. and chinese GDP ( PPP Basis ) as a share of Global Total : 1980-2018 ( % )

|

|

|

Source: IMF, World Economic Outlook, April 2019 .

|

The PPP measurement besides raises China ‘s 2018 nominal per caput GDP ( from $ 9,608 ) to $ 18,110, which was 28.9 % of the U.S. floor. even with continued rapid economic growth, it would probable take many years for chinese life standards to approach U.S. levels .

China as the World’s Largest Manufacturer

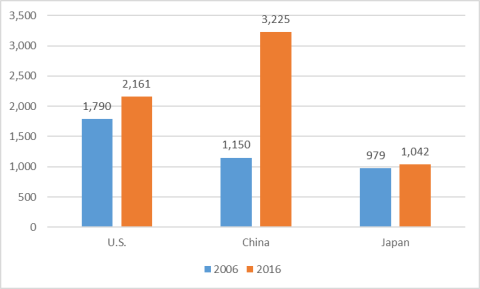

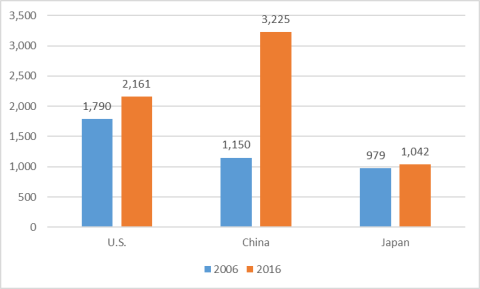

China has emerged as the global ‘s largest manufacturer according to the World Bank. Figure 8 lists estimates of the arrant value added of manufacture in China, the United States, and Japan expressed in U.S. dollars in 2006 and 2016. Gross value added data reflect the actual value of manufacturing that occurred in the nation ( i.e., they subtract the prize of intermediate inputs and raw materials used in production ). In 2016, the value of China ‘s fabricate on a arrant value added basis was 49.2 % higher than the U.S. horizontal surface. Manufacturing plays a well more important function in the taiwanese economy than it does for the United States. In 2016, China ‘s gross valued added manufacture was adequate to 28.7 % of its GDP, compared to 11.6 % for the United States. 21

visualize 8. Gross Value Added Manufacturing in China, the United States, and Japan : 2006 and 2016

( $ billions )

|

|

|

Source: The World Bank .

|

In its 2016 Global Manufacturing Competitiveness Index, Deloitte ( an international consult firm ) ranked China as the world ‘s most competitive manufacturer ( out of 40 countries ), based on a surveil of ball-shaped fabrication executives, while the United States ranked moment ( it ranked fourth in 2010 ). The index found that global executives predicted that the United States would overtake China by 2020 to become the world ‘s most competitive economy, largely because of its heavy investment in endowment and technology ( e.g., high levels of R & D spending and activities, the presence of ace universities, and large amounts of speculation capital being invested in advanced technologies ). On the early hand, while China was expected to remain a major manufacture office because of its large R & D spend levels, movement toward higher-valued, boost manufacture, government policies to promote invention, and a large pool of graduates in science, engineering, technology and mathematics, it was viewed as facing several challenges, including a slowing economy, a descent in value-added manufacture and overcapacity in respective industries, rising british labour party costs, and a quickly aging population. As a result, China was projected to fall to the second-most competitive manufacturer by 2020. 22

More broadly, the World Economic Forum ( WEF ) produces an annual composition that assesses and ranks ( based on an index ) the global competitiveness of a area ‘s entire economy, based on factors that determine the degree of productivity of an economy, which in twist sets the level of prosperity that the country can achieve. The WEF ‘s 2018 Global Competitive Index ranked China as the world ‘s 28th-most competitive economy ( out of 140 economies ), while the United States ranked inaugural. 23

Changes in China’s Wage and Labor Cost Advantages

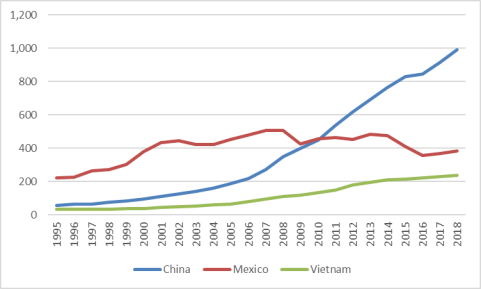

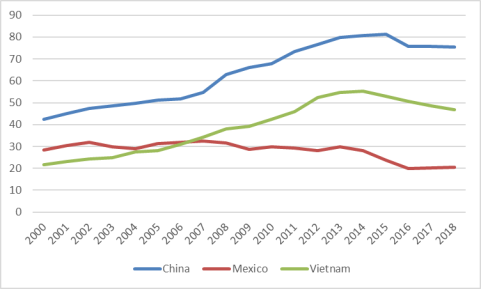

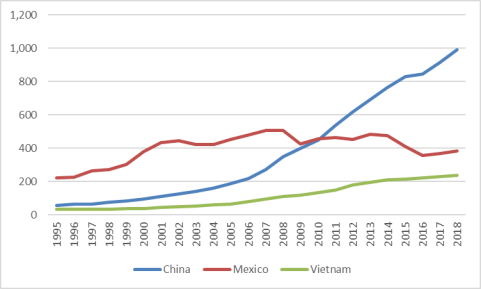

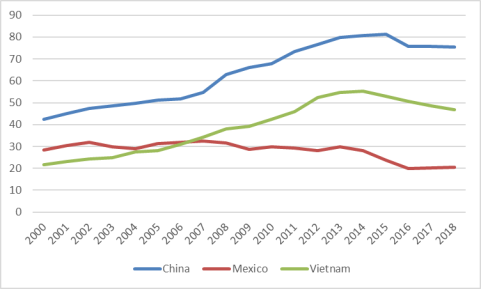

The decline in China ‘s working old age population may have contributed rising wages in China. As indicated in Figure 9, China ‘s average monthly wages ( converted into U.S. dollars ) in 1990 were $ 55, compared with $ 32 for Vietnam and $ 221 for Mexico. 24 however, in 2018, China ‘s modal monthly wages ( at $ 990 ) were 316 % higher than Vietnam ‘s wages ( $ 238 ) and 158.5 % higher than Mexico ‘s ( $ 383 ). From 2007 to 2018, China ‘s average monthly wages rose by 263 %. The american Chamber of Commerce in China ( AmCham China ) 2019 Business Climate survey listed rising labor costs as the second-biggest challenge facing U.S. firms in China ( 56 % of recipients cited them as their largest refer ). 25 Figure 10 shows a comparison of labor costs per unit of product for the countries listed in the previous figure, index relative to U.S levels. In 2000, China ‘s whole british labour party production costs were 42.3 of U.S. levels and by 2018 they rose to 75.5 % of U.S. levels. 26

calculate 9. modal monthly Wages for China, Mexico and Vietam : 1990-2018

( nominative U.S. dollars )

|

|

Source: Economist Intelligence Unit .

Notes: Because data are listed in U.S. dollars quite than local currentness, changes to wages may besides partially reflect changes to exchange rates with the U.S. dollar. however, such data may reflect average labor movement costs in dollars that U.S.-invested firms might face in their oversea operations .

|

trope 10. Labor Cost Index for China, Mexico, and Vietnam Relative to those in the United States : 2000-2018

( U.S. flat =100 )

|

|

Source: Economist Intelligence Unit .

Notes: The parturiency price of producing one unit of measurement of output, index to U.S. levels .

|

Foreign Direct Investment (FDI) in China

China ‘s trade and investment reforms and incentives led to a scend in FDI beginning in the early 1990s. such flows have been a major beginning of China ‘s productivity gains and rapid economic and trade emergence. There were reportedly 445,244 foreign-invested enterprises ( FIEs ) registered in China in 2010, employing 55.2 million workers or 15.9 % of the urban work force. 27 As indicated in Figure 11, FIEs account for a meaning share of China ‘s industrial output. That level rose from 2.3 % in 1990 to a eminent of 35.9 % in 2003, but fell to 25.9 % in 2011. 28 In summation, FIEs are responsible for a meaning floor of China ‘s alien craft. At their peak, FIEs accounted for 58.3 % of taiwanese exports in 2005 and 59.7 % of imports, but these levels have subsequently fallen, reaching 41.7 % and 43.7 %, respectively, in 2018 ( see Figure 12 ) .

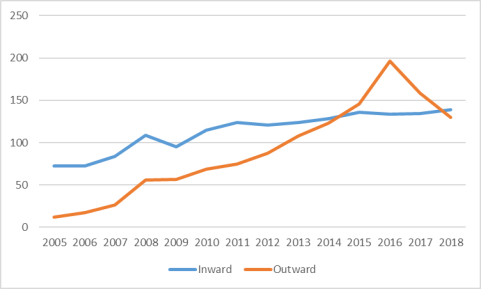

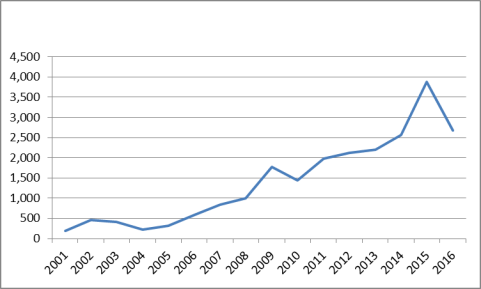

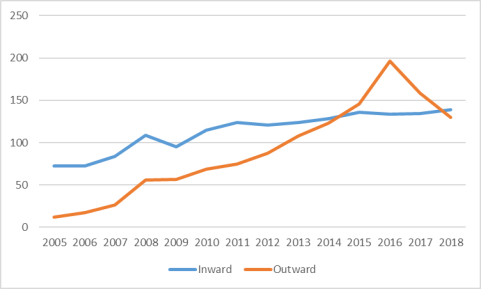

The United Nations Conference on Trade and Development ( UNCTAD ) reports that China has become a both a major recipient of global FDI arsenic well as a major supplier of FDI outflows ( see Figure 13 ). 29 China ‘s FDI inflows in 2018 were $ 139 billion, making it the world ‘s second-largest recipient role of FDI after the United States. 30 China ‘s FDI outflows have grew quickly after 2005 and exceeded FDI inflows for the first base time in 2015. China ‘s FDI outflows reached a historic bill of $ 196.1 billion in 2016, but declined in 2017 and 2018, reflecting a crackdown by the chinese politics on investing deemed wasteful and well as greater scrutiny by extraneous governments of China ‘s efforts to obtain advanced technology firms and other strategic assets. still, China was the world ‘s second-largest beginning of FDI outflows ( after Japan ) .

figure 13. Estimates of China ‘s annual FDI Inflows and Outflows : 2005-2018

( $ billions )

|

|

Source: UNCTAD

Notes : UNCTAD FDI data differ from that reported by China .

|

The sharply addition in China ‘s ball-shaped FDI outflows in recent years appears to be largely driven by a number of factors, including chinese politics policies and initiatives to encourage firms to “ go ball-shaped. ” The government wants to use FDI to gain access to IPR, technology, know-how, celebrated brands, and so forth, in club to move chinese firms up the value-added chain in manufacture and services, boost domestic initiation and growth of Chinese brands, and help chinese firms ( particularly SOEs ) to become major global competitors. 31 China ‘s slowing economy and rising labor movement costs have besides encouraged greater chinese oversea FDI in order to help firms diversify risk and extend occupation opportunities beyond the China grocery store, and, in some cases, to relocate less competitive firms from China to low-cost countries. China ‘s Ministry of Foreign Trade ( MOFCOM ) reports that in 2018, Chinese nonfinancial FDI in BRI countries totaled $ 15.6 billion, up 8.9 % over the previous year. 32 additionally, increased FDI outflows may be the result of the chinese government attempting to diversify its foreign commute reservation holdings ( which totaled $ 3.1 trillion as of April 2019—by far the global ‘s largest holder ). The largest extraneous investors in China ( based on FDI stock through 2017 ) were Hong Kong ( 52.6 % of sum ), 33 the british Virgin Islands ( 10.6 % ), Japan ( 6.1 % ), Singapore ( 4.0 % ), and Germany ( 3.2 % ) ( see Table 2 ) .

mesa 2. chinese Data on Top Ten Sources of China ‘s FDI Inflows to China : 1979-2017

( $ billions and percentage of full )

|

country

|

Estimated accumulative Utilized

FDI : 1979-2017

|

|

|

Amount

|

% of Total

|

|

sum

|

2,688

|

100

|

|

Hong Kong

|

1,241

|

46.2

|

|

british Virgin Islands

|

286

|

10.6

|

|

Japan

|

165

|

6.1

|

|

Singapore

|

108

|

4.0

|

|

Germany

|

87

|

3.2

|

|

S. Korea

|

73

|

2.7

|

|

U.S .

|

72

|

2.7

|

|

Cayman Islands

|

49

|

1.8

|

|

The Netherlands

|

37

|

1.4

|

|

Taiwan

|

33

|

1.2

|

Source: IMF Coordinated Direct Investment Survey .

Factors Driving China’s FDI Outflow Strategy

A key aspect of China ‘s economic modernization and growth strategy during the 1980s and 1990s was to attract FDI into China to help boost the development of domestic firms. investment by chinese firms afield was sharply restricted. however, in 2000, China ‘s leaders initiated a new “ go ball-shaped ” scheme, which sought to encourage chinese firms ( primarily SOEs ) to invest oversea. One key component driving this investment is China ‘s massive accumulation of foreign exchange reserves. traditionally, a significant tied of those reserves has been invested in relatively condom but low-yielding assets, such as U.S. Treasury securities. On September 29, 2007, the chinese government formally launched the China Investment Corporation ( CIC ) in an campaign to seek more profitable returns on its alien exchange reserves and diversify away from its U.S. dollar holdings. 34 The CIC was originally funded at $ 200 billion, making it one of the world ‘s largest sovereign wealth funds. 35 Another factor behind the government ‘s drive to encourage more outward FDI flows has been to obtain natural resources, such as oil and minerals, deemed by the government as necessary to sustain China ‘s rapid economic growth. 36 finally, the chinese government has indicated its finish of developing globally competitive chinese firms with their own brands. Investing in foreign firms, or acquiring them, is viewed as a method acting for taiwanese firms to obtain engineering, management skills, and often, internationally recognized brands, needed to help chinese firms become more globally competitive. For case, in April 2005, Lenovo Group Limited, a taiwanese calculator ship’s company, purchased IBM Corporation ‘s personal calculator class for $ 1.75 billion. 37 The largest destinations of accumulative Chinese FDI outflows through 2017 were Hong Kong ( 54.2 % of sum ), the Cayman Islands ( 13.9 % ), the british Virgin Islands ( 6.7 % ), and the United States ( 3.7 % ) ( see Table 3 ) .

table 3. major Destinations of taiwanese Nonfinancial FDI Outflows by Stock through 2017

( $ billions and percentage of total )

|

finish

|

stock of FDI through 2017

|

share of FDI Stock through 2017 ( % )

|

|

total

|

|

|

|

Hong Kong

|

|

|

|

Cayman Islands

|

|

|

|

british Virgin Islands

|

|

|

|

United States

|

|

|

|

Singapore

|

|

|

|

Australia

|

|

|

|

United Kingdom

|

|

|

Source: China Natural Bureau of Statistics .

Note : Ranked according to the lead seven destinations of the lineage of taiwanese FDI outflows through 2017 .

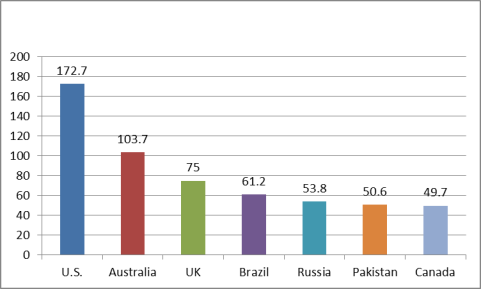

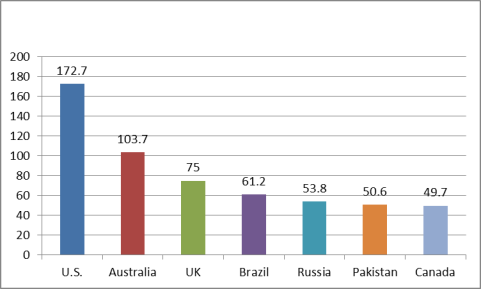

A significant level of chinese FDI that goes to Hong Kong, the british Virgin Islands, and the Cayman Islands likely is redirected elsewhere. The american Enterprise Institute ( AEI ) maintain the China Global Investment Tracker ( CGIT ), a database that has been developed to track the actual flows ( from the rear company to the final examination address ) of chinese investment globally. The CGIT database tracks FDI valued at $ 100 million or more ( which it refers to as “ China ‘s outbound non-bond investment ” ). 38 These data differ significantly from official chinese FDI spring data. The CGIT data on the top destinations of sum chinese outward non-bond outbound investment from 2005 to 2017 included the United States ( $ 172.7 billion ), Australia ( $ 103.7 billion ), the United Kingdom ( $ 75 billion ), Brazil ( $ 61.2 billion ), and Russia ( $ 53.8 ) ( see Figure 14 ). 39

number 14. AEI Estimates of Chinese Cumulative Outward Investment by Major destination : 2005-2017

( $ billions )

|

|

Source: AEI China Global Investment Tracker .

Notes: Data includes outbound FDI and valued at $ 100 million or more. These data differ importantly from official U.S. and chinese government data which rely on different methodologies .

|

China’s Merchandise Trade Patterns

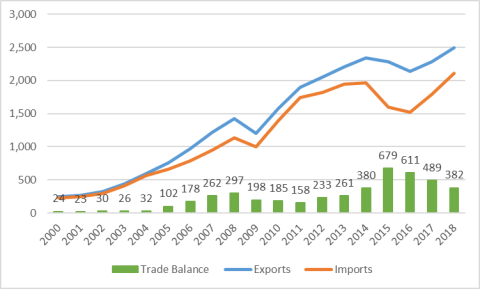

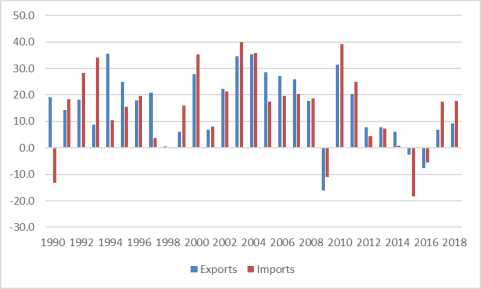

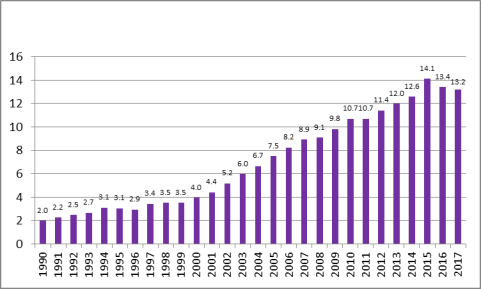

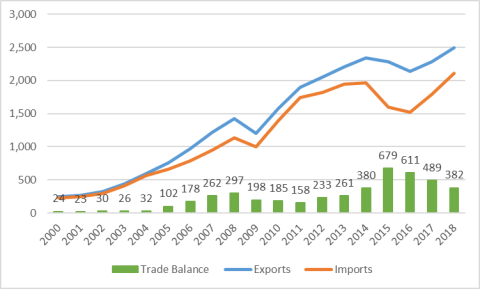

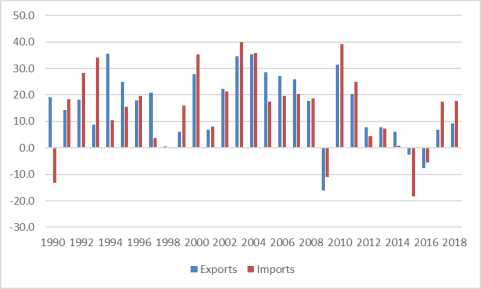

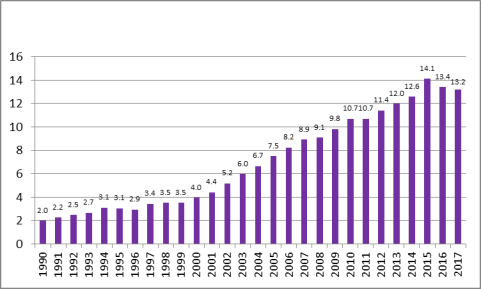

economic reforms and deal and investment liberalization have helped transform China into a major trade power. chinese merchandise exports rose from $ 14 billion in 1979 to $ 2.5 trillion in 2018, while trade imports grew from $ 18 billion to $ 2.1 trillion ( see Table 4 and Figure 15 ). China ‘s quickly growing barter flows have made it an increasingly significant ( and frequently the largest ) trade partner for many countries. According to China, it was the largest trade partner for 130 countries in 2013. 40 From 2000 to 2008, the annual emergence of China ‘s merchandise exports and imports averaged 25.1 % and 24.2 %, respectively. however, China ‘s exports and imports fell by 15.9 % and 11.2 %, respectively, due to the impingement of the ball-shaped fiscal crisis. China ‘s deal recovered in 2010 and 2011, with export growth averaging 25.8 % and meaning increase averaging 31.9 %. however, since that time, China ‘s trade emergence slowed sharply. From 2012 to 2014, China ‘s exports and imports grew at an average annual rate of 7.2 % and 4.1 %, respectively. From 2015 to 2016 exports and imports fell by an average rate of 4.7 % and 11.6 %, respectively ( see Figure 16 ), reflecting a sluggish global economy and a decline in commodity prices ( such as oil and ores ). however, in 2017, China ‘s exports and imports rose by 6.7 % and 17.4 %, respectively. Exports and imports in 2018 rose by 9.3 and 17.8 %, respectively. however, during the first three months of 2001, China ‘s exports grew by 1.0 %, while imports fell 1.1 % year-over-year. China ‘s trade trade excess grew aggressively from 2004 to 2008, rising from $ 32 billion to $ 297 billion. That excess fell each year over the next three years, dropping to $ 158 billion in 2011. however, it rose in each of the adjacent four years, reaching a record $ 679 billion in 2015 before falling to $ 611 billion in 2016, $ 489 billion in 2017, and $ 382 billion in 2018. In 2009, China overtook Germany to become both the world ‘s largest trade exporter and the second-largest merchandise importer ( after the United States ). In 2012, China overtook the United States as the world ‘s largest trade trade economy ( exports plus imports ). As indicated in Figure 17, China ‘s contribution of ball-shaped merchandise exports grew from 2.0 % in 1990 to 14.1 % in 2015, but fell to 13.4 % in 2016 and to 13.2 % in 2017 .

table 4. China ‘s Global Merchandise Trade : 1979-2018

( $ billions )

|

year

|

Exports

|

Imports

|

Trade Balance

|

|

1979

|

13.7

|

15.7

|

-2.0

|

|

1980

|

18.1

|

19.5

|

-1.4

|

|

1985

|

27.3

|

42.5

|

-15.3

|

|

1990

|

62.9

|

53.9

|

9.0

|

|

1995

|

148.8

|

132.1

|

16.7

|

|

2000

|

249.2

|

225.1

|

24.1

|

|

2001

|

266.2

|

243.6

|

22.6

|

|

2002

|

325.6

|

295.2

|

30.4

|

|

2003

|

438.4

|

412.8

|

25.6

|

|

2004

|

593.4

|

561.4

|

32.0

|

|

2005

|

762.0

|

660.1

|

101.9

|

|

2006

|

969.1

|

791.5

|

177.6

|

|

2007

|

1,218.0

|

955.8

|

262.2

|

|

2008

|

1,428.9

|

1,131.5

|

297.4

|

|

2009

|

1,202.0

|

1,003.9

|

198.2

|

|

2010

|

1,578.4

|

1,393.9

|

184.5

|

|

2011

|

1,899.3

|

1,741.4

|

157.9

|

|

2012

|

2,050.1

|

1,817.3

|

232.8

|

|

2013

|

2,210.7

|

1,949.3

|

261.4

|

|

2014

|

2,343.2

|

1,963.1

|

380.1

|

|

2015

|

2,280.5

|

1,601.8

|

678.8

|

|

2016

|

2,135.3

|

1,524.7

|

610.6

|

|

2017

|

2,279.2

|

1,790.0

|

489.2

|

|

2018

|

2,491.4

|

2,109.0

|

382.4

|

Source: Global Trade Atlas and China ‘s Customs Administration .

figure 15. China ‘s Merchandise Trade : 2000-2018

( $ billions )

|

|

Source: World Trade Atlas and China ‘s Customs Administration .

Note : Data are in U.S. dollars which may be impacted by changes in substitution rates .

|

figure 16. annual Change in China ‘s Merchandise Exports and Imports : 2000-2018

( share )

|

|

Source: Global Trade Atlas and China ‘s Customs Administration .

Note: Data are in U.S. dollars which may be impacted by changes in exchange rates ampere well as commodity prices .

|

figure 17. China ‘s share of Global Merchandise Exports : 1990-2017

( percentage )

|

|

Source : economist Intelligence Unit .

Note : Data for 2017 are estimated .

|

China’s Major Trading Partners

Table 5 lists official chinese trade data on its seven largest trading partners in 2018 ( based on sum barter ). These include the 28 countries that make up the European Union ( EU28 ), the United States, the 10 nations that constitute the Association of Southeast asian Nations ( ASEAN ), Japan, South Korea, Hong Kong, and Taiwan. 41 China ‘s top three export markets were the United States, the EU28, ASEAN, 42 while its top sources for imports were the EU28, ASEAN, and South Korea. According to Chinese data, it maintained big trade surpluses with the United States ( $ 282 billion ), Hong Kong ( $ 274 billion ) and the EU28 ( $ 129 billion ), and reported bombastic trade imbalances with Taiwan ( $ 112 billion ) and South Korea ( $ 74 billion ). China ‘s trade data differ significantly from those of many of its deal partners. These differences appear to be largely caused by how China ‘s craft via Hong Kong is counted in official taiwanese deal data. China treats a boastfully partake of its exports through Hong Kong as chinese exports to Hong Kong for statistical purposes, while many countries that import chinese products through Hong Kong by and large attribute their beginning to China for statistical purposes, including the United States. 43

mesa 5. China ‘s major trade Trading Partners in 2018

( $ billions )

|

nation

|

total Trade

|

Chinese Exports

|

taiwanese Imports

|

China ‘s Trade Balance

|

|

European Union

|

|

|

|

|

|

United States

|

|

|

|

|

|

association of southeast asian nations

|

|

|

|

|

|

Japan

|

|

|

|

|

|

South Korea

|

|

|

|

|

|

Hong Kong

|

|

|

|

|

|

Taiwan

|

|

|

|

|

Source: China ‘s Customs Administration .

Note s : Rankings according to China ‘s entire trade in 2018. China ‘s bilateral trade data frequently differ from that of its trade partners .

Major Chinese Trade Commodities

China ‘s abundance of low-cost labor has made it internationally competitive in many low-cost, labor-intensive manufactures. As a result, manufactured products constitute a significant share of China ‘s trade. A significant amount of China ‘s imports is comprised of parts and components that are assembled into finished products, such as consumer electronic products and computers, and then exported. Often, the value-added to such products in China by chinese workers is relatively little compared to the full value of the merchandise when it is shipped afield .

China ‘s top 10 imports and exports in 2018 are listed in Table 6 and Table 7, respectively, using the harmonized duty system ( HTS ) on a two-digit level. major imports included electrical machinery and equipment ; 44 mineral fuels ; nuclear reactors, boilers, and machinery ( such as automatic data process machines and machines to make semiconductors ) ; ores ; and ocular, photographic, checkup, or surgical instruments. China ‘s biggest exports were electrical machinery and equipment ; nuclear reactors, boilers, and machinery ; furniture ; plastics ; and vehicles .

board 6. major chinese Merchandise Imports in 2018

|

HS Code

|

description

|

$ Billions

|

percentage of

Total Exports

|

2018/2017

% deepen

|

|

|

Total Commodities

|

2,117

|

100

|

18.3

|

|

|

electric machinery and equipment

|

522

|

24.6

|

14.2

|

|

|

Mineral fuel, oil etc .

|

348

|

16.4

|

41.5

|

|

|

nuclear reactors, boilers, and machinery

|

202

|

9.6

|

18.8

|

|

|

Ores, slag, and ash

|

135

|

6.4

|

8.3

|

|

|

Optical, photographic, cinematographic, measuring

check, preciseness, medical or surgical instruments

and apparatus ; parts and accessories thereof

|

103

|

4.8

|

5.2

|

|

|

Vehicles, except railroad track, and parts

trucks, and bicycles )

|

81

|

3.9

|

2.9

|

|

|

cherished stones and metals

|

61

|

2.9

|

328.6

|

|

|

copper and articles thereof

|

48

|

2.3

|

15.5

|

|

|

petroleum seeds, misc. grain, plants, and fruit

|

43

|

2.1

|

-2.7

|

|

|

pharmaceutical products

|

28

|

1.3

|

10.8

|

Source: World Trade Atlas, using official taiwanese statistics .

Note : Top 10 imports in 2018, two-digit level, harmonized duty system .

table 7. major chinese Merchandise Exports in 2018

|

HS Code

|

description

|

$ Billions

|

percentage of

Total Exports

|

2017/2016

% switch

|

|

|

full Commodities

|

2,489

|

100

|

|

|

|

electrical machinery

|

664

|

26.7

|

|

|

|

nuclear reactors, boilers, and machinery

|

429

|

17.3

|

|

|

|

furniture and bed

|

96

|

3.9

|

|

|

|

Plastics and articles thereof

|

80

|

3.2

|

|

|

|

Vehicles, except railway, and parts

|

75

|

3.0

|

|

|

|

Apparel articles and accessories, knit or crochet

|

74

|

3.0

|

|

|

|

Apparel articles and accessories, weave

|

71

|

2.9

|

|

|

|

Optical, photographic, cinematographic, measuring

check, preciseness, aesculapian or surgical instruments

and apparatus ; parts and accessories thereof

|

71

|

2.9

|

|

|

|

Articles of iron or steel

|

65

|

2.6

|

|

|

|

organic chemicals

|

60

|

2.4

|

|

Source: World Trade Atlas, using official chinese statistics .

Note : Top 10 exports in 2018, two-digit flat, harmonized tariff system .

Major Long-Term Challenges Facing the Chinese Economy

China is presently undergoing a major restructure of its economic model. Policies that were employed in the by to basically produce rapid economic increase at any cost were identical successful. however, such policies have entailed a number of costs ( such as heavy contamination, widening income inequality, overcapacity in many industries, an ineffective fiscal system, rising corporate debt, and numerous imbalances in the economy ) and therefore the old increase model is viewed by many economists as no longer sustainable. China has sought to develop a raw growth mannequin ( “ the new normal ” ) that promotes more sustainable ( and less dearly-won ) economic increase that puts greater vehemence on private pulmonary tuberculosis and initiation as the new drivers of the chinese economy. Implementing a new growth model that sustains goodly economic increase could prove challenging unless China is able to effectively implement modern economic reforms. many analysts warn that without such reforms, China could face a menstruation of stagnant economic growth and living standards, a condition referred to by economists as the “ middle-income trap ” ( Several of these challenges are discussed below .

China’s Incomplete Transition to a Market Economy

Despite China ‘s three-decade history of far-flung economic reforms, chinese officials contend that China is a “ socialist-market economy. ” This appears to indicate that the politics accepts and allows the use of free grocery store forces in a count of areas to help grow the economy, but the government silent plays a major function in the nation ‘s economic growth .

Industrial Policies and SOEs

According to the World Bank, “ China has become one of the global ‘s most active voice users of industrial policies and administrations. ” 45 China ‘s State Council has said that there are presently 150,000 SOEs at the central and local anesthetic government degree. 46 China ‘s SOEs may account for up of 50 % of non-agriculture GDP. 47 In accession, although the count of SOEs has declined sharply, they continue to dominate a number of sectors ( such as petroleum and mine, telecommunications, utilities, exile, and respective industrial sectors ) ; are shielded from rival ; are the main sectors encouraged to invest abroad ; and dominate the listings on China ‘s sprout indexes. 48 One sketch found that SOEs constituted 50 % of the 500 largest fabrication companies in China and 61 % of the exceed 500 serve sector enterprises. 49 not only are SOEs dominant allele players in China ‘s economy, many are quite large by global standards. Fortune ‘s 2016 list of the earth ‘s 500 largest companies includes 103 taiwanese firms ( compared to 29 list firms in 2007 ). 50 Of the 103 taiwanese firms listed, Fortune identified 75 companies ( 73 % of full ) where the politics owned 50 % or more of the company. together, these 75 firms in 2016 generated $ 7.2 trillion in revenues, had assets valued at $ 20.7 trillion, and employed 16.2 million workers. Of the 28 other chinese firms on the Fortune 500 list, several appear to have fiscal links to the chinese government .

China and Global Steel Overcapacity

China has become a major global manufacturer of steel. From 2001 to 2016, China ‘s production of raw steel rose from 152 million measured tons to 805 million metric unit tons, an increase of 459.9 %. During this menstruation, China ‘s share of global production rose from 17.9 % to 50.3 % and China accounted for 87.1 % of the increase in ball-shaped steel production. 51 While much of China ‘s increase steel capacity has been in reply to domestic demand ( resulting from China ‘s large-scale pay back investment ), it is besides a major exporter. In 2015, China was the second-largest exporter of semifinished and sword products ( after the EU ) at 111.6 million system of measurement tons, or 24.1 % of global total .

Concerns have been raised over the past few years over the effects of increased ball-shaped steel production despite falling ball-shaped steel demand. Following an EU Symposium on Excess Capacity and Structural Adjustment in the Steel Sector in April 2016, then-U.S. Secretary of Commerce Penny Pritzker and then-USTR Michael Froman issued a joint statement that said that the “ U.S. steel industry is in a crisis driven in boastfully depart by ball-shaped surfeit capacity …. led by unsustainable expansion in steelmaking capacity by China, ” and noted that global steel overcapacity had impacted the U.S. industry through price declines, decreased profitableness, and over 13,000 jobs lost. 52

many analysts contend that China ‘s steel industry is heavy supported by politics entities at the cardinal and local government level through low-cost accredit and subsidies. These enable many taiwanese steel firms to operate, flush when they are unprofitable and heavily in debt—these are termed by some as “ zombies. ” The government is loath to allow such firms to go bankrupt due to concerns over effects layoffs could have on social stability. One discipline by Renmin University estimated that half of chinese steel firms were “ zombie enterprises. ” 53 In April 2016, the USTR released a list of 86 government subsidies from 2011 to 2014 given to Hebei Iron & Steel Company, one of the largest steel companies in China, which was obtained from the company ‘s annual reports. 54

In February 2016, the taiwanese politics announced plans to shut 100 million to 150 million metric tons of crude steel capacity over the future five years and cut 500,000 jobs. 55 The USTR ‘s 2016 report on China ‘s WTO submission stated that China had committed to “ ensure that no central politics plans, policies, directives, guidelines, lend or grant targets the net expansion of steel capacity, ” and to take steps to reduce existing capability, including “ actively and appropriately dispose of ‘zombie enterprises ‘ through bankruptcies and other means. ” 56

|

A State-Dominated Banking Sector, Excess Credit, and Growing Debt

China ‘s banking system is largely dominated by state-owned or collectivist banks. According to one analyst, the mangers of China ‘s submit banks are drawn from the ranks of the Chinese Communist Party cell organization, which “ enables the party and government leaderships to exert influence over bank lend. ” 57 In 2015, the circus tent five largest banks in China in terms of assets were state-owned entities. 58 The percentage share of assets held by state-owned commercial banks ( including the five large state-owned banks ), the three government policy banks, 59 and joint-stock commercial banks ( where government entities are a major stock holder ), together accounted for 68.5 % of total bank assets in China. 60 Foreign engagement in China ‘s trust system is relatively humble, accounting for 1.6 % of total bank assets. 61 SOEs are believed to receive discriminatory credit treatment by government banks, while private firms must often pay higher matter to rates or obtain accredit elsewhere. According to one estimate, SOEs accounted for 85 % ( $ 1.4 trillion ) of all bank loans in 2009. 62 It is believed that oftentimes SOEs do not repay their loans, which may have saddled the banks with an ever-increasing amount of nonperforming loans. 63 many analysts contend that one of the biggest weaknesses of the bank system is that it lacks the ability to ration and allocate credit according to market principles, such as gamble assessment .

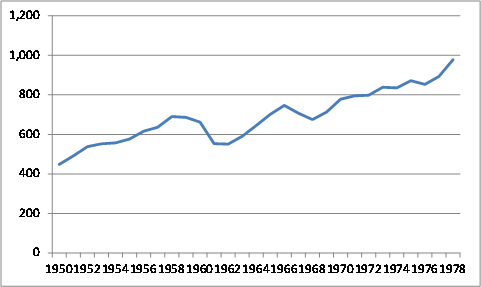

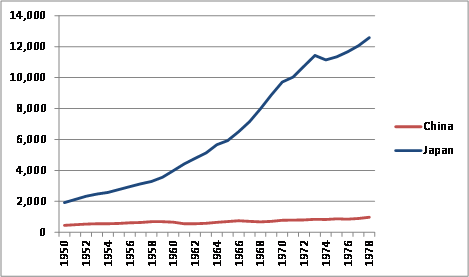

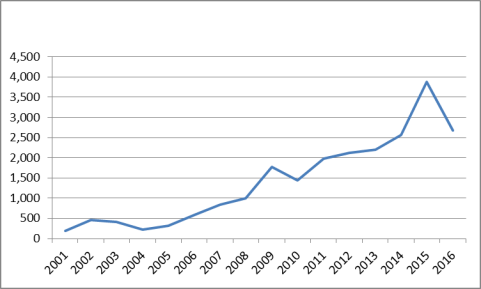

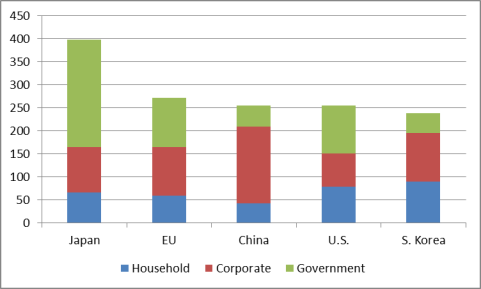

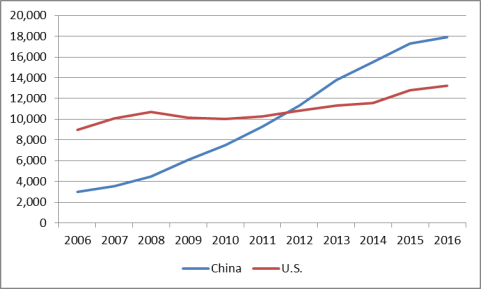

The taiwanese cardinal government uses the bank system to boost credit in order to help meet its GDP growth objectives and to, when needed, offset the impact of ball-shaped economic downturns, such as after the 9/11 terrorist attacks and the ball-shaped fiscal crisis. From 2007 to 2016, China ‘s domestic credit increased in dollar terms by 218 % ( see Figure 18 ), and as a share of GDP, the level rose from 125 % to 212 %. As indicated in Figure 19, China ‘s blend family, corporate, and politics debt levels as a percentage of GDP as of mid-2016 are comparable to those of the United States and South Korea and lower than those of Japan and the European Union. however, China ‘s debt levels ( in both dollars and as a share of GDP ) have risen sharply within a relatively curtly time, which, some have speculated, could spark an economic crisis in China in the future. From 2006 year-end to mid-2016, China ‘s full nonfinancial sector debt as a share of GDP increased from 143 % to 254 % ( up 111 percentage points ). much of the wax in that debt came from the bodied sector, which, as a share of GDP, rose from 107 % in 2006 to 171 % in mid-2016 ( up 64 share points ). In dollar terms, China ‘s corporate debt rose from $ 3 trillion to $ 17.8 trillion ( up $ 14.8 trillion ) and presently greatly exceeds U.S. bodied debt levels ( see Figure 20 ). several observers have warned that China ‘s credit growth may be besides extensive and could undermine future emergence by aggressively boosting debt levels, causing overcapacity in many industrials ( specially extending credit to firms that are unprofitable to keep them operating ), contributing to bubbles ( such as in real estate ), and reducing productivity by proving discriminatory treatment to SOEs and other government-supported entities .

name 18. annual Change in the Stock of China ‘s domestic Credit 2001-2016

( $ billions )

|

|

|

Source: Economist Intelligence Unit .

|

name 19. Core Debt of Nonfinancial Sectors in 2016* as a share of GDP

for Selected Economies

( percentage )

|

|

Source: Bank for International Settlements .

Note : * As of second base quarter 2016 .

|

figure 20. U.S. and taiwanese Corporate debt : 2006-2016*

( $ billions )

|

|

Source: Bank for International Settlements .

Note : *As of second quarter 2016 .

|

local politics debt is viewed as a big problem in China, largely because of the potential impact it could have on the Chinese trust system. During the beginning of the global fiscal slowdown, many Chinese subnational government entities borrowed extensively to help stimulate local anesthetic economies, particularly by supporting infrastructure projects. In December 2013, the chinese National Audit Office reported that from the end of 2010 to mid-year 2013, local government debt had increased by 67 % to about $ 3 trillion. 64 The chinese government reported that local politics debt rose to $ 4.3 trillion as of 2015. Efforts have been made over the past few years by the central government to restructure local government debt and restrict local politics borrow, with shuffle success, according to some crush reports, because of pressures on local governments to maintain rapid economic growth. 65

many economists blame China ‘s close capital report for much of China ‘s debt problems. The taiwanese government has maintained restrictions on capital inflows and outflows for many years, in part to control the exchange of its currency, the renminbi ( RMB ), against the dollar and other currencies in order to boost exports. many argue the taiwanese government ‘s restrictions on das kapital flows have greatly distorted fiscal markets in China, preventing the most efficient consumption of capital, such as overinvestment in some sectors ( such as real estate of the realm ) and underinvestment in others ( such as services ) .

Environmental Challenges

China ‘s economic growth model has emphasized the emergence of heavy diligence in China, much of which is energy-intensive and senior high school pollute. The grade of befoulment in China continues to worsen, posing serious health risks to the population. The chinese government often disregards its own environmental laws in order to promote rapid economic emergence. China ‘s environmental challenges are illustrated by the be incidents and reports .

- A 2018 report by ExxonMobil estimated that China contributed about 60% of the growth in global CO2 emissions from 2000 to 2016, and that its emissions would surpass the combined CO2 levels of the United States and EU by 2025.66

- A 2017 OECD report estimated the health costs of China’s air pollution in 2015 at $1.4 trillion, equivalent to 7.8% of its GDP.67

- A 2015 study by the Rand Corporation estimated that the costs (in terms of health impact and lost productivity) from China’s air pollution were equal to 6.5% of GDP each year from 2000 to 2010. It further estimated the costs as a percentage of GDP of water pollution and soil degradation at an additional 2.1% and 1.1%, respectively.68

- On August 12, 2015, a series of large explosions in several warehouses containing chemicals occurred in the Chinese port city of Tianjin, claiming the lives of at least 163 people. Some press reports have blamed poor government enforcement of environmental regulations for the disaster. For example, some in China have questioned why dangerous chemicals were warehoused so close to residential areas and have raised concerns over the extent of chemical contamination in the area that may have resulted from the explosions.

- The U.S. Embassy in Beijing, which monitors and reports air quality in China based on an air quality index of particulate matter (developed by the U.S. Environmental Protection Agency) considered to pose a health concern, reported that the air quality in Beijing for a majority of the days in January 2013 ranged from “unhealthy” to “hazardous” (based on 24-hour exposure) and, on a few days, it recorded high readings that were “beyond index.”69 The level of poor air quality in Beijing was termed by some in China as “Airpocalypse,” and reportedly forced the government to shut down some factories and reduce the level of official cars on the road.70 On December 9, 2013, China’s media reported that half of China was blanketed by smog.71 The U.S. Consulate General in Shanghai reported that were a number of days in December 2013 where its measurement of the air quality in Shanghai was hazardous or very unhealthy, and during some time periods on December 5, 2013, its readings were “beyond index.” According to the U.S. Embassy in Beijing, from 2008 to 2015, nearly two-thirds of the days in Beijing had air pollution considered to be unhealthy.72

- In February 2013, China’s Geological Survey reportedly estimated that 90% of all Chinese cities had polluted groundwater, with two-thirds having “severely polluted” water.73

- According to a 2012 report by the Asian Development Bank, less than 1% of the 500 largest cities in China meet the air quality standards recommended by the World Health Organization, and 7 of these are ranked among the 10 most polluted cities in the world.74

The chinese government has indicated that it is taking steps to reduce department of energy consumption, boost enforcement of environmental laws and regulations, reduce coal use by expanding the consumption of cleaner fuels ( such as natural gas ) to general office, and relocate high-polluting factories away from boastfully urban areas, although such efforts have had mixed results on the overall flush of befoulment in China. 75 In summation, China has become a major ball-shaped producer and exploiter of clean and renewable department of energy technology. In January 2017, the chinese government said it would spend $ 361 billion on renewable energy exponent genesis by 2020. 76

Corruption and the Relative Lack of the Rule of Law

The relative lack of the rule of police in China has led to far-flung government corruption, fiscal speculation, and misallocation of investment funds. In many cases, politics “ connections, ” not commercialize forces, are the chief determinant of successful firms in China. many U.S. firms find it unmanageable to do business in China because rules and regulations are broadly not coherent or crystalline, contracts are not well enforced, and cerebral property rights are not protected ( due to the lack of an independent discriminative system ). The proportional lack of the rule of law and far-flung government corruptness in China specify competition and undermine the efficient allotment of goods and services in the economy. A New York Times article reported that ( former ) Chinese Premier Wen Jiabao ‘s family controlled assets worth at least $ 2.7 billion. 77 One learn estimates that between 2001 and 2010, China was the world ‘s largest source of illegitimate capital outflows at $ 3.8 trillion. 78 A 2012 survey by the Pew Research Center ‘s Global Attitudes Project reported that 50 % of respondents said that crooked officials are a very big problem ( up from 39 % in 2008 ). 79 taiwanese officials much name government corruption as the greatest threat to the Chinese Communist Party and the state. The taiwanese government ‘s anticorruption watchdog reported that 106,000 officials were found guilty of corruption in 2009. 80 Since assuming exponent in 2012, Chinese Xi Jinping has carried out an extensive anticorruption repel. China has reportedly sought cooperation with the United States to obtain extradition of 150 allege corrupt officials who have fled to the United States. 81 however, many analysts contend that government anticorruption campaigns are chiefly used to settle political scores with out-of-favor officials. Some analysts contend that President ‘s Xi anticorruption drive is more about consolidating his own political than instituting reforms. 82 In addition, there are some indicators that the current anticorruption political campaign may be having a negative impact on the chinese economy, due to reluctance by some local officials to pursue projects they feel will lead to scrutiny from the central politics. 83 many observers argue that meaningful advancement against government corruption can not occur without greater politics transparency, a system of checks and balances, a release crush, Internet freedom, and an independent judiciary. 84 In October 2014, China held its fourth Plenum of the 18th Party Conference. The meet focused on the need to enhance the dominion of law in China, but emphasized the leave function of the Communist Party in the legal system. 85

China maintains a faint and relatively decentralized government structure to regulate economic bodily process in China. Laws and regulations often go unenforced or are ignored by local government officials. As a leave, many firms cut corners in order to maximize profits. This has led to a proliferation of dangerous food and consumer products being sold in China or exported abroad. miss of government enforcement of food safety laws led to a massive recall of melamine-tainted baby milk formula that reportedly killed at least four children and sickened 53,000 others in 2008. Transparency International ‘s Corruption Perception Index for 2016 ranked China 79th out of 176 countries and territories, up from 72nd in 2007. 86

Demographic Challenges

many economists contend that China ‘s demographic policies, particularly its one-child policy ( beginning implemented in 1979 ), are beginning to have a significant impact on the chinese economy. For example, according to a McKinsey Global Institute study, China ‘s birthrate rate fell from about 5.8 births per womanhood in 1964 to 1.6 in 2012. 87 This is now affecting the size of the chinese work force .

The being of a boastfully and underemployed labor force out was a significant factor in China ‘s rapid economic growth when economic reforms were first introduced. Such a large labor military unit meant that firms in China had access to a closely endless provide of low-cost undertaking, which helped enable many firms to become more profitable, which in call on led them to boost investing and production. Some economists contend that China is beginning to lose this department of labor advantage. According to the chinese government, the size of its working long time population ( ages 16 to 59 ) peaked at 925 million in 2011, but then fell for seven consecutive years to 897 million in 2018. The taiwanese government projects that its working long time population will drop to 830 million by 2030 and to 700 million by 2050. If these projections prove accurate, the Chines working long time population could drop by 225 million individuals ( 2011-2050 ). 88

The one-child policy has besides resulted in a quickly aging society in China. 89 According to the Brookings Institute, China already has 180 million people aged over 60, and this could reach 240 million by 2020 and 360 million by 2030. The population plowshare of people aged over 60 could reach 20 % by 2020, and 27 % by 2030. 90 With a declining working population and a rising aged population, the taiwanese politics will face challenges trying to boost worker productivity ( such as enhancing initiation and high-end technology development ) and expanding outgo on health care and aged services. China ‘s Hukou ( family registration ) system besides poses challenges to the politics .

China ‘s Hukou System 91

first introduced in 1951, the taiwanese Hukou ( family registration ) arrangement is a classification of its citizens based on both their identify of mansion and eligibility for certain socioeconomic benefits. Hukou is issued through a registration process administered by local authorities and solidified into inheritable social identities. 92 The categorization of the system is composed by two related parts : socioeconomic eligibility ( agriculture/nonagriculture ) ; and residential location ( living in urban/rural areas ). The chinese government imposed the organization with the purpose of regulating population distribution, particularly in regard to cities. Since economic reforms were begun in 1979, hundreds of millions of people have been allowed to leave their home towns to work in urban areas, such as Shanghai. The number of rural laborers working in China ‘s cities was 274 million in 2014, over one-third ( 36 % ) of the sum work force. 93 Although such workers are allowed to reside in the cities where they work, they are generally traverse access to social entitlements, such as pensions, checkup indemnity, and basic education for children. This forces such workers to save a very high level of their income to pay for these services. due to China ‘s desire to increase the urbanization of its population, combat demographic disparities, and boost domestic consumption, the chinese politics is presently considering implementing newly reforms to the Hukou system .

|

Economic Goals of the 19th Party Congress of the Communist Party

President Xi ‘s composition to the 19th Party Congress in November 2017 stated that socialism with chinese characteristics had entered a new era. He stated that China would work to become a “ moderately golden society in all respects ” by 2050. major goals include boosting live standards for poor and rural people, addressing income disparities ( for example, rich-poor and urban-rural ), making private consumption the driver of the economy, boosting services, reducing pollution, promoting invention and economic modernization, and improving overall populate standards. 94 For example, the report states the follow :

We will work faster to build China into a manufacturer of choice and develop advance manufacture, promote far integration of the internet, big data, and artificial intelligence with the real economy, and foster new growth areas and drivers of growth in medium-high goal consumption, innovation-driven exploitation, the green and low-carbon economy, the sharing economy, modern supply chains, and human capital services. We will support traditional industries in upgrading themselves and accelerate development of modern service industries to elevate them to international standards. We will move Chinese industries up to the medium-high end of the global rate chain, and foster a number of first advanced fabricate clusters .

The report indicated that China would continue to pursue craft and investment reforms, noting the follow :

We will adopt policies to promote high-standard liberalization and facilitation of trade and investment ; we will implement the organization of pre-establishment national treatment plus a negative tilt across the board, importantly relief market access, far open the serve sector, and protect the legitimate rights and interests of foreign investors. All businesses registered in China will be treated equally .

however, the report emphasized the stay importance of the state of matter sector and the government ‘s continue character in versatile economic sectors :

We will improve the systems for managing different types of country assets, and reform the system of authoritative operation of state capital. In the state-owned sector, we will step up improved distribution, structural adjustment, and strategic reorganization. We will work to see that state of matter assets maintain and increase their value ; we will support state capital in becoming stronger, doing better, and growing bigger, and take effective measures to prevent the loss of state assets. We will further reform of state-owned enterprises, develop mixed-ownership economic entities, and turn chinese enterprises into first, globally competitive firms. 95

China’s Belt and Road Initiative

China ‘s Belt and Road enterprise ( BRI ), besides called “ One Belt, One road ” ( OBOR ), was launched in 2013 to boost economic integration and connectivity ( such as infrastructure, trade, and investment ) with its neighbors and assorted trading partners in Asia, Africa, Europe, and beyond. 96 At the APEC peak in November 2017, President Xi said the follow :

The Belt and Road Initiative calls for joint contribution and it has a authorize focus, which is to promote infrastructure construction and connectivity, tone coordination on economic policies, enhance complementarity of development strategies and boost coordinated development to achieve common prosperity. This inaugural is from China, but it belongs to the worldly concern. It is rooted in history, but it is oriented toward the future. It focuses on the Asian, European and African continents, but it is open to all partners. I am confident that the launch of the Belt and Road Initiative will create a broader and more dynamic platform for Asia-Pacific cooperation. 97