Geneva, Switzerland, 3 October 2018

– Africa ’ s minimal consolidation in worldly concern trade is reflected in the shape of its nautical sector yet this portends an enormous opportunity for the global ’ sulfur youngest and second-most populous continent.

Seaborne trade wind

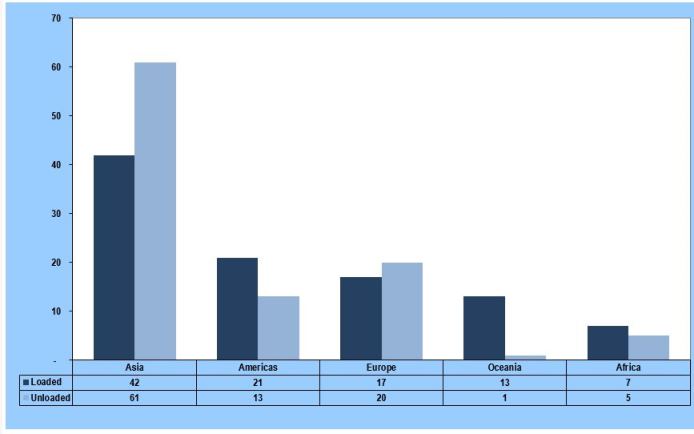

Africa relies heavily on ships and ports to service its intercontinental trade. While it accounts for approximately 2.7 % of ball-shaped trade by rate, the continent contributes higher shares to ball-shaped seaborne trade – 7 % and 5 % of maritime exports and imports by volume, respectively. While one-third of african countries are landlocked, nautical transport remains the main gateway to the global market.

Maritime trade in Africa is shaped by the continent ’ second trade concentration and limited diversification. accordingly, 40 % of goods exported by sea in 2017 comprised of crude anoint, while over two-thirds of imports were accounted for by dry cargoes ( dry bulks and containerize goods ) and close to 20 % of imports were made up of petroleum products and natural gas.

The European Union remains Africa ’ s major trade partner although its share of trade has declined from about one-half in 1995 to one-third in 2017. In holocene years, the plowshare of deal with the United States of America has fallen while trade with China has increased : China, and Asia in general, have incrementally cut into the EU and US share of african trade. This is opening new opportunities for the celibate both as a consumer market ampere well as a potential manufacture region, for example, as shown by growing fabric and garment fabricate action in Ethiopia.

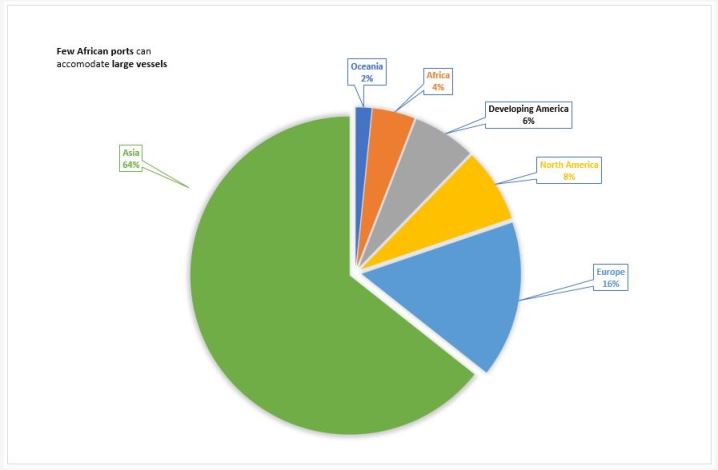

Africa ’ south ports account for 4 % of global containerize trade volume, much of which comprises imports of manufacture goods. Africa ’ s ship and ports do not always match ball-shaped trends and standards. apart from four container terminals in Morocco, Egypt and South Africa, no other african port was featured in the 2016 list of acme 100 global container ports.

Demand and issue patterns

By diversifying their economies and enabling greater consolidation into regional and global value chains, Africa can improve its containerize deal and port traffic volumes and come forth as an exporter of containerize goods. For this to happen, however, craft policy and regional integration initiatives such as the African Continental Free Trade Agreement ( AfCFTA ) will not be enough.

Africa ’ s container ports and backwoods enchant networks need to support these efforts by upgrading infrastructure and services, and improving performance, to match international standards. This entails, among other things, enhancing productiveness levels : on average, crane productivity is around 20 moves per crane per hour in West Africa, 25 to 30 in South Africa, and 35 to 40 in Asia.

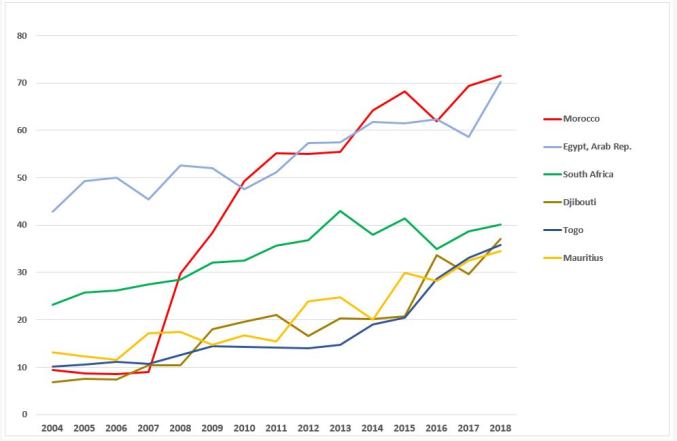

Shipping connectivity, which significantly influences transport cost levels, is below the ball-shaped average in Africa. african countries shipping connectivity is powerfully influenced by their geography. The best-connected countries are those at the continent ’ s corners, where external ship routes connect to hub ports, notably in Morocco, Egypt and South Africa. They are followed by sub-regional cargo centres, notably Djibouti, Togo and Mauritius ( see chart ). Combinations of public and private investments, port reforms, and improved transit to connect to neighbouring landlocked countries have helped these countries to become leaders in African container shipping connectivity.

Being a meaning drug user and importer of nautical transportation services, Africa has for many years sought to increase its participation in the provision of transportation services. This has yet to be achieved, however, as the continent ’ s possession of the world evanesce is limited, with no african area among the top 35 ship-owning nations in 2017. This is besides apparent when considering nationally flagged fleets. lone Liberia makes the list of top iris States, ranking third globally after Panama and Marshall Islands regarding nationally flagged tonnage.

Africa ’ s maritime transportation demand and add patterns underscore the electric potential of african countries both as users and providers of maritime ecstasy services. They can do this by leveraging growth prospects and build on comparative advantages like abundant low-cost labor and long coasts to house nautical occupation industries.

The way ahead

While many challenges constrain the continent ’ s ability to in full take its place in the ball-shaped economic arena, several factors on the top indicate that Africa is a abeyant giant. Factors supporting Africa in this travel include full-bodied economic increase, a demographic dividend, resources, growing investment and finance commitments relating to transport infrastructure, including by China.

UNCTAD supports Africa in these endeavours with respective flagship programmes. These include port management, trade wind facilitation and sustainable freight transport technical aid programmes, equally well as close collaboration with the African Union towards achieving the AfCFTA. UNCTAD besides actively supports customs reforms with its ASYCUDA program, which is implemented in most african countries.

A portfolio of measures involving targeted interventions by national, regional and international players that align with the Sustainable Development Goals and mainstream the three dimensions of sustainable development as applied to transport and trade facilitation are required to help Africa fulfil its likely. These include :

• Preparing african ports to accommodate larger vessels through dredging for water depth and ensuring adequate cargo handling equipment is in stead.

• Improving entree to the backwoods and landlocked countries by multimodal transport and enchant corridor approaches and build inland transmit infrastructure.

• Making use of relevant technologies and digital solutions to facilitate transportation and craft, cutting inefficiencies, improving processes and enhancing foil, and promoting security and resilience of enchant systems.

• Enhancing transport connectivity either on the sea or land side to reduce transport costs and improve african countries ’ placement in the ball-shaped transport networks. This besides must encompass enabling soft infrastructure in accompaniment of transit transmit and trade facilitation by harmonizing transport regulation, including road and rail transport.

• Encouraging greater engagement in nautical business by promoting maritime clusters where ship and interface activities can boost refer services sectors, including in the context of the Blue Economy.

Figure 1: Top 6 African Liner Shipping Connectivity Index (LSCI), 2004-2018

Source : UNCTAD liner shipping connectivity index database : hypertext transfer protocol : //unctadstat.unctad.org/wds/TableViewer/tableView.aspx ? ReportId=92

Reading: Maritime trade and Africa | UNCTAD

Figure 2: World Container Port Traffic, 2017

beginning : UNCTAD – Review of Maritime Transport 2018

Figure 3: World Seaborne Trade by Region, 2017

source : source : UNCTAD – Review of Maritime Transport 2018