Annual growth in maritime trade between 2022 and 2026 will slow to 2.4%, compared to 2.9% over the past two decades, a new UNCTAD report predicts.

The Review of Maritime Transport 2021 published on 18 November examines the impact of the COVID-19 pandemic on nautical craft volumes and how the ship crisis is affecting economic recovery and threatening the delivery of critical vaccines and food supplies.

The COVID-19 pandemic ’ randomness impingement on maritime trade volumes in 2020 was less dangerous than initially expected but its knock-on effects will be far-reaching and could transform maritime ecstasy, according to UNCTAD .

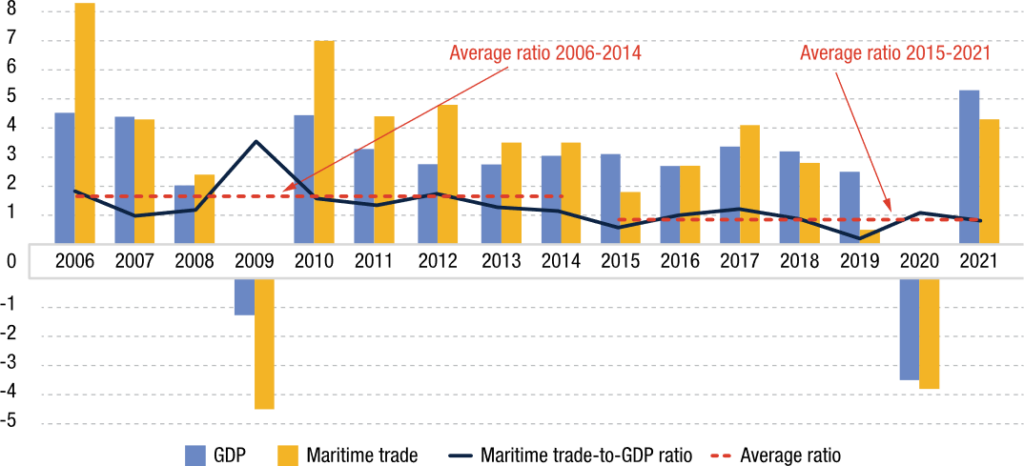

The report shows that maritime trade contracted by 3.8 % in 2020, reflecting an initial shock, but it rebounded later in the year and is projected to increase by 4.3 % in 2021, in tandem with the recovery in merchandise craft and worldly concern output. The medium-term lookout for nautical trade remains positive but subject to “ mounting risks and uncertainties ” .

Source: UNCTAD

Source: UNCTAD

Headwinds buffet maritime trade

While acknowledging the nascent recovery, the report paints a picture of unprecedented pressures in ball-shaped provide chains, dramatic spikes in freight rates, significant price rises on the horizon for consumers and importers and likely shifts in trade patterns due to trade tensions and in the bay for more resilience .

“ A persistent recovery will depend on the path of the pandemic and largely hinges on being able to mitigate the headwinds and on a worldwide vaccine roll-out, ” said UNCTAD Secretary-General Rebeca Grynspan .

“ The impacts of the COVID-19 crisis will hit humble island developing states ( SIDS ) and least develop countries ( LDCs ) the hardest, ” Grynspan explained .

UNCTAD says the pandemic exposed and magnified challenges that already existed in the nautical transportation industry, notably british labour party shortages and infrastructure needs .

It raises business over the continuing pandemic-induced crisis around crew changes, with lockdowns, surround closures and lack of external flights leaving hundreds of thousands of seafarers stranded at ocean, unable to be replaced or repatriated .

Related Article

-

Posted:

6 months ago

NDCCI: Crew change crisis shows no signs of relief

Posted:

6 months ago

The report calls for pressing attention from ease up, port and labour-supplying states to end the crew change crisis, insisting that all states should be parties to relevant international legal instruments, including the Maritime Labour Convention of 2006. It urges governments and industry to continue working together and in collaboration with relevant international organizations to facilitate crew changes .

Related Article

-

Posted:

11 months ago

Over 300 industry leaders sign Neptune Declaration to end crew change crisis

Posted:

11 months ago

Read more: Maritime search and rescue – Documentary

Factors driving consumer prices higher

The report found that provision chain bottlenecks have hindered economic recovery, as the rebound in trade has run into pandemic-induced logistic challenges, including shortages of equipment and containers, less reliable services, congested ports and longer delays and harp times .

Supply-side constraints in container ship are besides rocking maritime transportation and trade. While orders for new ships declined by 16 % in 2020, continuing a down drift of previous years, in 2021 transport companies responded to the capacity limitations with a rush of new orders .

Shipping lines have benefitted from soaring freight rates, the report notes, as surcharges, fees and rates temporarily hiked even further after the container ship Ever Given blocked the Suez Canal in March 2021 .

Related Article

-

- long read

Posted:

9 months ago

One of the world’s largest containerships blocks Suez Canal

Posted:

9 months ago

The increasing costs of container shipping have been a challenge for all traders and issue chain managers, says the reputation, but specially sol for smaller shippers, who may be less able to absorb the extra expense and are at a disadvantage when negotiating rates and booking space on ships. If the current tide in container freight rates continues, it will importantly increase both import and consumer prices, the report warns .

UNCTAD ’ s analysis predicts that global consequence monetary value levels will increase on average by 11 % as a leave of the cargo rate increases, but SIDS that chiefly depend on nautical transport for their imports could face increases of up to 24 %. If container freight rates remain at their current high levels, ball-shaped consumer prices are projected to be 1.5 % higher in 2023 than they differently would have been. however, the rise is expected to be 7.5 % in SIDS and 2.2 % in LDCs .

“ In the face of these cost pressures and lasting market dislocation, it is increasingly important to monitor market behavior and ensure transparency when it comes to setting rates, fees and surcharges, ” the report recommends .

Megatrends shaping maritime transport

The pandemic has accelerated megatrends that could transform maritime transport in the longer term, the report states .

It has catalysed digitalization and automation, which should deliver efficiency and monetary value savings. however, the shipping diligence is besides coming to grips with climate adaptation and resilience, and the pressing necessitate to decarbonize and find alternative fuels to reduce emissions, which will inevitably come at a monetary value, says UNCTAD .

“ By exposing the vulnerabilities of existing supply chains, the COVID-19 disruption has sharpened the want to build resilience and revived the debate over globalization and the supply chains of the future, ” said Shamika N. Sirimanne, UNCTAD ’ s director of engineering and logistics .

On concerns over increased reshoring and nearshoring the report points out that it may be straightforward to reshore labor-intensive and low-value production, but it ’ south more complex to move product and substitution suppliers for mid- and high-value-added fabrication. The report predicts a blend of reshoring, diversification, rejoinder and regionalization, with China still probably to remain a leading manufacture site.

Read more: What is the Maritime Industry?

“ Hybrid ” operating models involving just-in-time and just-in-case issue chain models are likely to emerge. These adjustments could lead to a demand for more compromising ship services, with implications for vessel types and sizes, ports of call and distances travelled .

meanwhile e-commerce, accelerated by the pandemic, has transformed consumer shop habits and spend patterns and driven the demand for distribution facilities and warehousing that are digitally enabled and offer value-added services. This could generate new business opportunities for ship and ports .

Looking ahead, UNCTAD says ball-shaped socioeconomic recovery will depend on smart, bouncy and sustainable nautical transport and a broad-based worldwide vaccination feat, with developing countries having fair access to vaccines. It urges diligence, governments and external organizations to ensure that seafarers are designated as key workers and vaccinated as a topic of priority .